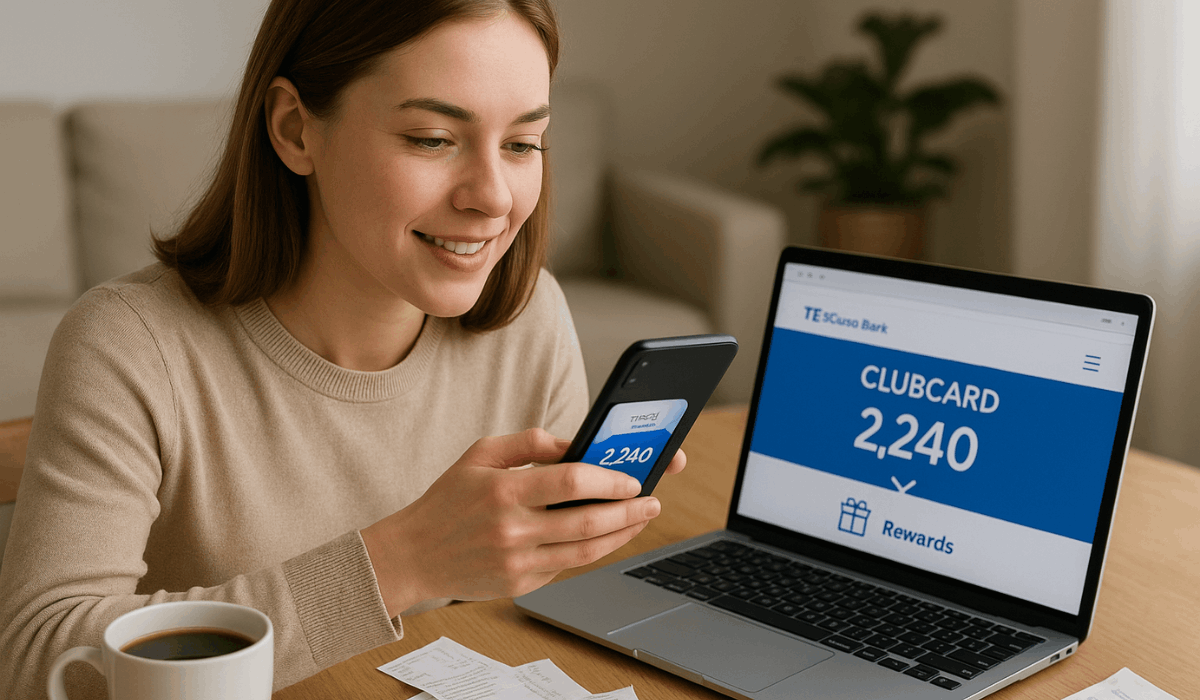

The Tesco Bank Clubcard Credit Card lets you earn points every time you shop at Tesco or other stores.

It’s a convenient option if you want rewards and flexible spending with no annual fee.

You can easily apply online in minutes using Tesco Bank’s secure application system.

What the Card Offers

Here are the main features of the Tesco Bank Clubcard Credit Card — so you can see clearly what you get.

- Clubcard Points – Earn rewards when you spend at Tesco and other retailers.

- No Annual Fee – Most card versions don’t charge a yearly maintenance fee.

- Promotional Offers – Enjoy 0% interest for a set period on purchases or balance transfers.

- Low APR Option – Choose a variant with a lower variable APR if you prefer fewer promotions.

- Online Management – Control your account through Tesco Bank’s website or mobile app.

- Clubcard Integration – Your credit card doubles as your Tesco Clubcard for instant rewards.

- Flexible Spending – Use the card in-store, online, and abroad where Mastercard is accepted.

- Secure Transactions – Includes fraud protection and transaction alerts for added safety.

Interest Rates & Fees

Here are the key interest rates and fees you’ll face with the Tesco Bank Clubcard Credit Card.

This gives you clarity so you can compare and decide whether the card fits your financial plan.

- Representative APR – The standard interest rate for most cardholders is around 24.9% variable.

- Low APR Option – A lower-rate version at 10.9% variable, ideal if you prefer steady rates over promotions.

- 0% Introductory Offer – Temporary period (e.g., 14 months) with no interest on purchases or transfers.

- Balance Transfer Fee – A 3.99% fee when you move balances from another card.

- Money Transfer Fee – A 3.99% charge when transferring funds to your bank account.

- Cash Withdrawal Fee – 3.99% (minimum £3) applied when using your card to withdraw cash.

- Foreign Transaction Fee – 2.75% on purchases made abroad or in foreign currencies.

- Late Payment Fee – £12 charge if you miss the minimum payment.

- Annual Fee – No yearly cost on most Tesco Bank Clubcard Credit Card versions.

Eligibility Requirements

Here are the key eligibility requirements for applying for this card.

Meeting these doesn’t guarantee approval, but you should satisfy them before you apply.

- You must be aged 18 or over.

- You must be a UK resident.

- You need to have a UK bank or building society account.

- You must provide proof of income or affordability, including details of earnings and outgoings.

- Good credit history and low existing debt levels improve your chances (approval is “subject to status”).

Step-by-Step: How to Apply Online

Here’s a clear, straightforward guide to the online application process for the Tesco Bank Clubcard Credit Card.

Follow these steps to apply smoothly and know what to expect.

- Visit the Website – Go to the official Tesco Bank site and select the Clubcard Credit Card you want.

- Check Eligibility – Use the free tool to see your approval chances without affecting your credit score.

- Start Application – Begin the online form if you’re eligible to proceed.

- Enter Personal Details – Provide your name, date of birth, and full UK address history.

- Add Financial Info – Include your employment status, income, and regular expenses.

- Review Terms – Read the interest rates, fees, and card conditions carefully before submitting.

- Submit Form – Send your application and wait for an instant or follow-up decision.

- Activate Card – Once approved and the card arrives, activate it via online banking or the Tesco Bank app.

Tips for a Smooth Application

Here are some practical tips to make your card application quick and smooth.

Follow these steps to improve your chances of approval and avoid delays.

- Check Your Credit Report – Make sure your information is accurate and free of errors before applying.

- Use the Eligibility Checker – Try Tesco Bank’s online tool to see if you’re likely to be approved without affecting your credit score.

- Prepare Your Details – Have your income, address history, and employment information ready.

- Avoid Multiple Applications – Don’t apply for several credit cards at once; it can lower your credit rating.

- Keep Debts Low – Pay down existing credit balances to show responsible financial behaviour.

- Apply for the Right Card Variant – Choose between a low-APR or rewards card depending on your spending habits.

- Review Terms Carefully – Understand the rates, fees, and rewards before submitting your application.

What Happens After You’re Approved

Here’s what happens after you’re approved for the Tesco Bank Clubcard Credit Card — so you know what to expect next and how to start using the card.

- Card arrival – Your card typically arrives within 5-7 working days after approval.

- PIN delivery – Your PIN is sent separately, usually within 3-5 working days.

- Activation – Once you receive the card, you’ll need to activate it (via the mobile app or online banking) before use.

- Set up online account – Log into online banking or register for the mobile app to manage your card, view statements, and make payments.

- Start earning rewards – Begin using your card for purchases so you can collect Clubcard points and any bonus rewards offered.

- Statements & payments – You’ll receive monthly statements. Set up a direct debit or schedule payments to avoid late fees and interest.

- Credit-limit management – Your initial credit limit is set. After using the card responsibly for a period, you may be eligible for a limit increase.

Customer Support Options

Below are the main customer support options available so you can easily find assistance when you need it.

- Phone Support (General Credit-Card Enquiries) – Call 0345 300 4278 in the UK.

- Phone Support (Lost or Stolen Card / Suspected Fraud) – Call +44 1268 50 80 27 from abroad, or the UK number for domestic calls.

- Online Banking & Mobile App Helpdesk – For issues logging in or using the app. Call 0345 300 3511.

- Security & Fraud Enquiries – Dedicated service for fraud concerns. Phone 0345 300 4278 for credit cards, available 24/7 for lost & stolen cards.

- Help & Support Centre / FAQs – Online resource with guides, FAQs, and self-help tools covering card usage, payments, disputed transactions, etc.

- Financial Difficulty Support – If you’re struggling with payments, the bank provides help, and you should contact them early.

- Accessibility & Alternative Contact Methods – Support for customers with hearing or speech difficulties (e.g., Relay UK, BSL interpreters).

To Sum Up

The Tesco Bank Clubcard Credit Card is a smart choice if you want to earn rewards on everyday spending while managing your finances efficiently.

With simple online access, flexible options, and no annual fee, it suits both new and regular card users.

Apply online today through Tesco Bank’s official website to start earning Clubcard points with every purchase.

Disclaimer

Information in this article is based on publicly available details from Tesco Bank and may change without notice.

Always check the official Tesco Bank website for the latest rates, fees, and terms before applying.