The Sainsbury’s Nectar Credit Card lets you earn Nectar points every time you shop, both at Sainsbury’s and with partner brands.

It’s designed for those who want rewards while managing daily spending responsibly.

This guide shows you how to apply online, understand the card’s fees and rates, and start using it effectively.

Key Features & Benefits

Here are the key features and benefits of the Sainsbury’s Nectar Credit Card — to help you decide if it suits your spending and rewards goals.

- Earns Nectar points for every purchase you make, helping you get value back from everyday spending.

- Bonus points for spending at specific stores like Sainsbury’s, Argos, and Tu Clothing — better rewards in those places.

- No annual fee (in some versions), making it more attractive if you use it without paying extra simply to hold the card.

- Introductory offers such as 0% interest on purchases or balance transfers for a limited time.

- Points are part of the wider Nectar loyalty programme — you can redeem them in multiple ways across partner outlets.

- An online account and management of your card, which gives you transparency and control over your spending.

Interest Rates & Fees

Here are the current interest rates and fees for this card. It’s essential you understand these before applying, so you’ll know the real cost if you don’t clear your balance.

Rates and fees may change, so always check the official terms.

- Representative APR (variable): 22.9% for the standard version of the card.

- Annual fee: £0 (no yearly fee) for this version.

- Balance transfers & 0% offers: Some versions have 0% on balance transfers for up to 29 months with a transfer fee (e.g., 2.89%).

- Foreign transaction fee (non-sterling purchases): Approx. 2.75% (as shown for similar cards).

- Cash withdrawal fee: Around 3% of the amount withdrawn (minimum £3) when taking cash from the card.

Before You Apply: What You’ll Need

Before you start your online application, make sure you have the correct details and documents ready.

This helps speed up the process and improves your chances of approval.

- Personal information – Include your full name, date of birth, contact number, and email address.

- Residential details – Provide your current address and how long you’ve lived there; if less than three years, include your previous address.

- Employment status – State your job title, employer name, and length of employment.

- Income details – List your total annual income, including salary and any additional sources of income.

- Financial commitments – Mention existing loans, credit cards, or regular monthly payments.

- Identification documents – Keep your photo ID and proof of address (like a utility bill or bank statement) available if verification is needed.

- Credit history check – Be prepared for a credit assessment, which helps determine eligibility and credit limit.

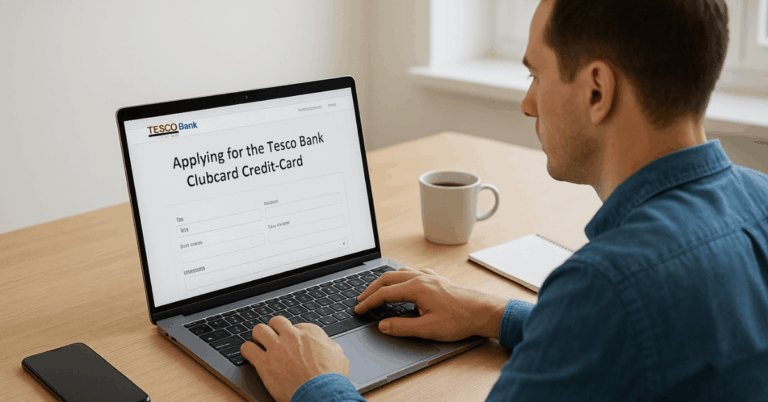

Step-by-Step: Applying Online

Here’s how you apply online for the Sainsbury’s Nectar Credit Card — step by step. Follow each part carefully so your application goes smoothly.

- Go to the Official Site – Visit Sainsbury’s Bank’s website and select the Nectar Credit Card page to begin your application.

- Click “Apply Now” – Start the online form by confirming you meet the eligibility requirements.

- Provide Personal Details – Enter your name, date of birth, and contact information accurately.

- Add Financial Information – Include income, employment details, and any current credit commitments.

- Review Terms & Conditions – Read the agreement carefully, focusing on rates, fees, and data use.

- Submit Your Application – Double-check all information, then send the form for instant or later review.

- Receive and Activate Your Card – Once approved, wait for delivery, activate the card, and set up online account access.

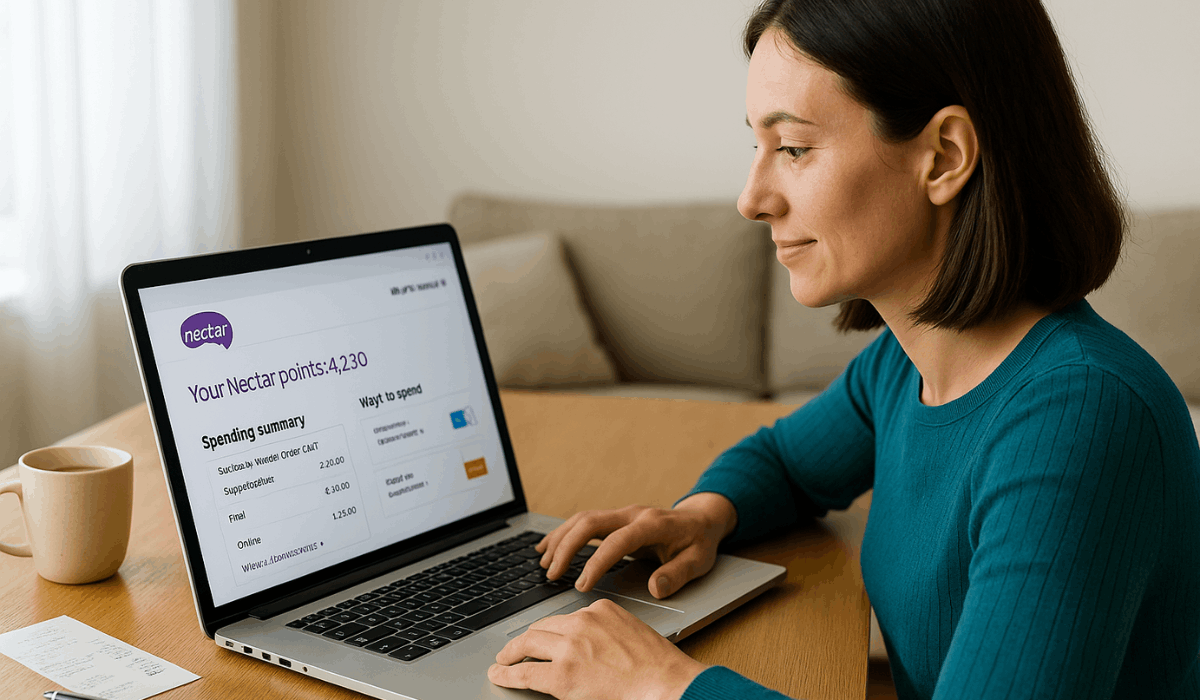

After Approval: What Comes Next

Once you’ve been approved for the card, it’s time to get things set up and start making it work for you. Here’s what you should do next.

- Activate your card – Once it arrives, follow the instructions (via online banking or phone) to activate it so it’s ready to use.

- Set up online account – Register for online access or mobile app so you can view statements, check balance, and monitor transactions.

- Link rewards – Connect your card to your Nectar account to start earning points on eligible purchases.

- Set up payments – Arrange a direct debit or preferred method to avoid missed payments and fees.

- Start using – Use the card for daily purchases and pay in full each month to avoid interest.

- Monitor activity – Check your account or app regularly to track spending and earned points.

- Review offers – Keep an eye on bonus promotions or temporary 0% interest periods.

- Update info – Ensure your contact and billing details are always current.

- Stay informed – Read notifications or emails about any card changes or updates.

Using the Card Abroad / Travel Considerations

If you plan to use the card while abroad, it’s essential to understand how overseas spending works and what extras you might face.

Below are key considerations to help you manage costs and avoid surprises when travelling.

- Foreign transaction fee – Non-sterling purchases usually cost about 2.75 % extra.

- Exchange rates – The bank’s conversion rate can affect how much you actually pay.

- ATM withdrawals – Cash advances abroad charge higher fees and interest from day one.

- Notify your bank – Inform them of your travel dates to prevent security blocks.

- Use travel cards – Consider a card with no FX fees for regular overseas spending.

- Pay in local currency – Avoid GBP conversions to skip hidden DCC charges.

- Check your benefits – Review if 0 % FX or travel insurance applies before your trip.

Things to Consider / Drawbacks

Before you apply, you should weigh up potential drawbacks so you’re clear about what might not suit your situation.

- Lower rewards value — The return on everyday spending is relatively weak compared with some other cards.

- High interest if you carry a balance — If you don’t pay in full, the cost of borrowing can offset any rewards.

- Dependent on regular usage — To make the card worth it, you’ll need to use it frequently at partner stores.

- Fees and restrictions apply — Some fees (foreign transaction, cash withdrawal) or special conditions may limit value.

- Changes in terms over time — Reward rates or partner offers may be reduced, altering the card’s attractiveness.

- Requires discipline — If you rush into spending or lose control, rewards become irrelevant.

- Not ideal if you shop rarely at partner stores — If your spending is primarily outside of the listed partners, you might get minimal benefit.

Contact Info for Support

If you have questions about your account, payments, or online access, Sainsbury’s Bank provides several ways to get in touch.

Below is a list of verified contact options you can use for quick and reliable support.

- Phone (card queries): 0345 788 8444 — for general credit card support

- Lost or stolen card emergency line: 0800 456 1232 (within UK) / +44 131 549 8040 (from abroad)

- Phone (linking to Nectar account via NatWest): 0345 366 7005

To Conclude

Applying for the Sainsbury’s Nectar Credit Card online is quick when you know what to prepare and how the process works.

Once approved, you can start earning rewards on your daily purchases while managing your account securely online.

Visit the official Sainsbury’s Bank website today and complete your application to enjoy the card’s full benefits.

Disclaimer

Details such as eligibility, interest rates, and rewards are subject to change and may vary based on individual circumstances.

Please refer to the official Sainsbury’s Bank website for the latest and most accurate information before applying.