In several EEA markets, Premium users can apply for a Revolut Premium Mastercard directly in-app, with decisions in minutes.

Revolut’s Premium plan pairs an exclusive, customisable card (issued on Mastercard or Visa, depending on your country) with priority support and higher limits.

Availability, pricing, and interest rates vary by region, so it’s important to rely on Revolut’s official pages and your in-app offer for the latest figures.

Key Features You Can Confirm Today

Revolut Premium benefits are valuable.

Request a limit (EEA examples show up to €10,000) and get a quick decision, then spend immediately with a virtual card while you wait for the physical one.

EEA pages state an interest-free grace period up to 62 days on purchases (conditions apply).

Introductory offer (example – Ireland): 0% interest on purchases for the first 3 months once you make at least the minimum repayment.

Representative APRs (examples by country)

Ireland: representative APR 17.99% (variable); example given for a €1,500 purchase.

Poland: representative APR 17.5% p.a. (with example assumptions published by Revolut).

Premium plan price (US): $9.99/month or $94.99/year; includes an exclusive card design and priority support.

Revolut Premium vs Standard and Metal

Here’s a concise, US-specific comparison of Revolut Premium Mastercard against Revolut’s other personal plans.

| Plan / Card (US) | Card network & type | FX allowance before fee | Out-of-network ATM: no-fee monthly limit* | APY on High-Yield Savings (as of 2025-08-20) | Travel/lifestyle perks (high level) |

|---|---|---|---|---|---|

| Standard | Visa or Mastercard (brand assigned automatically) — prepaid/debit | $1,000 / 30-day rolling; 1% extra fee outside market hours | N/A (2% fee on all OON ATMs) | 4.00% APY | No discounted lounge access; core app features |

| Premium | Visa or Mastercard (brand assigned automatically) — prepaid/debit; Premium-design card | $10,000 / 30-day rolling; no extra fee outside market hours | $800 (then 2% fee) | 4.50% APY | Priority in-app chat; discounted lounge access; higher plan limits |

| Metal | Visa or Mastercard (brand assigned automatically) — metal card | Unlimited; no extra fee outside market hours | $1,200 (then 2% fee) | 5.50% APY | Travel insurance (US underwriter noted in plan page); discounted lounge access; added lifestyle subscriptions |

Choose the Revolut premium card if you travel a handful of times per year, want bigger FX/ATM buffers, priority support, without paying for everything Metal includes.

If you’re mostly local and cost-focused, Standard is fine. If you want maximum travel perks and limits, go Metal.

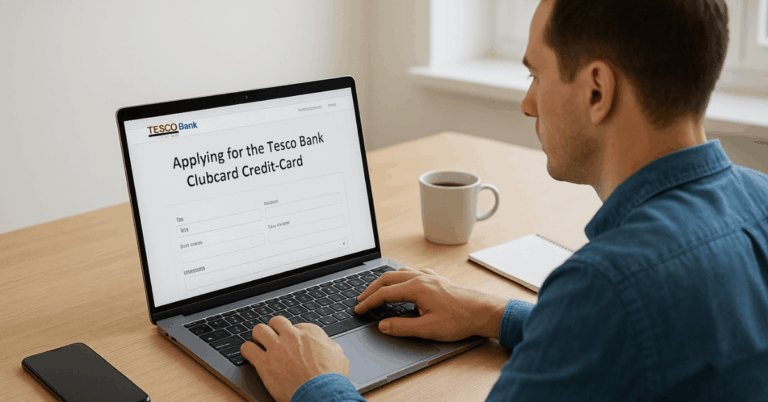

How to Apply for Revolut Premium Mastercard (in-app)

In the US, make sure you meet Revolut’s eligibility requirements (18+, valid SSN, resident, verifiable income, and 30+ days as a Revolut customer).

- Open or install the Revolut app and verify your identity (KYC).

- Upgrade to Premium in the app if you want the Premium plan’s card design, support, and higher limits (optional for applying for credit where not required).

- Navigate to “Credit Card” (the wording can vary slightly by region) and tap Apply. Enter your personal details and income information as prompted.

- Review your offer: the app will show your approved credit limit, APR/fees (if applicable), any introductory offer, your grace-period rules, and repayment options (full balance, minimum payment/revolving, or statement financing where available).

- Accept and order your card: you can spend immediately with a virtual card and order a physical card to your address.

- Activate controls: once the card arrives, enable 3-D Secure, set spending limits, and turn on push alerts. Interest accrues daily on unpaid balances after the due date.

Premium plan benefits that pair with the card

Priority, 24/7 in-app support, and faster queues.

Exclusive Premium card designs with personalisation options.

Higher limits (e.g., foreign exchange and ATM, depending on market) and higher savings APY vs. Standard in the US

(up to 4.50% APY for Premium as of late September 2025).

Contact Details (official, by region)

European Economic Area (Revolut Bank UAB)

- Registered address: Konstitucijos ave. 21B, Vilnius, LT-08130, Lithuania.

- Automated line to block a card: +370 5 214 3608 (automated; not a live agent).

United Kingdom (Revolut Ltd registered office)

- Address: 7 Westferry Circus, Canary Wharf, London, E14 4HD.

United States (Revolut Technologies Inc.)

- Mailing address: 107 Greenwich Street, 20th Floor, New York, NY 10006.

- Phone (US support line on card back): (844) 744-3512.

Tip: Revolut emphasises in-app chat for most support. For security, do not engage with unexpected phone calls claiming to be from Revolut unless they occur inside the app.

Practical Application Tips

Before you apply, open your country’s Revolut credit card page to see current limits, promotional offers, and the representative APR.

To benefit from interest-free purchases, pay the full statement balance on time and avoid carrying over any balance.

If your card is lost/stolen, freeze it in-app and use the automated phone line above to block if you can’t access the app.

Revolut Premium Mastercard Pros and Cons

Pros

- Higher fee-free FX allowance than Standard.

- Priority in-app support.

- Virtual and disposable cards for safer online shopping and easy card rotation.

- Better ATM allowance versus Standard.

- Travel extras are commonly included in many regions.

- Premium-design physical card (clean look; often faster replacement options).

- Higher plan limits across features.

- Potentially higher savings APY than Standard in some markets.

- Single app for everything.

Cons

- Monthly fee.

- Benefits vary by country.

- Insurance fine print.

- ATM operator fees may still apply even within your plan allowance.

- The card network (Visa/Mastercard) is typically assigned, not chosen by you.

- Credit card availability and APRs differ by market; the Premium plan doesn’t guarantee better credit terms.

- Some top-tier perks remain Metal-only.

Conclusion

Revolut Premium Mastercard delivers a decision quickly and combines a polished card with priority support and higher limits.

Interest rates and promotions are market-specific, with official Irish and Polish pages currently showing representative APRs around 17–18%.

If you’re ready, open the Revolut app, check your country’s credit-card page for the latest APR and fees, and submit your application.

Disclaimer: All product details, APRs, fees, contact numbers, and addresses depend on your country and may change. Always rely on the figures and legal terms shown in your Revolut app and on your local Revolut website at the time you apply.