Heavy PayPal spenders want simple, predictable value without extra tracking.

The PayPal Cashback Mastercard delivers a clean formula: 3% back at PayPal checkout and 1.5% back everywhere else Mastercard is accepted, paired with a $0 annual fee and quick virtual access after approval.

PayPal Cashback Mastercard

The essentials below reflect current issuer disclosures and program language. Treat APRs as examples that vary by profile and Prime Rate.

| Feature | Details |

| Annual fee | $0 (no annual fee credit card) |

| Rewards | 3% at PayPal checkout; 1.5% on other purchases |

| Purchase APR (variable) | 19.24%, 30.99%, or 33.99% (account-type dependent) |

| Foreign transaction fee | Foreign transaction fee 3% |

| Issuer / Network | Synchrony Bank credit card / Mastercard |

Why Choose It for Everyday Spending

Flat, always-on earn rates suit busy buyers who route purchases through PayPal. The card integrates directly with your PayPal wallet, supports Apple Pay, Google Pay, and Samsung Pay for contactless checkout, and includes Mastercard ID Theft Protection™.

Up to six authorized users can be added to help consolidate household spend. Rewards post after transactions settle and are redeemed to PayPal with no rotating categories to manage.

Important nuance on authorized users. PayPal states that an authorized user cannot add the card to their own PayPal account; 3% applies when the primary account uses the card at PayPal checkout. Plan PayPal transactions through the primary wallet to capture the elevated rate.

Rates, Fees, and Costs That Matter

Purchase APRs are variable and shown in tiers (e.g., 19.24% / 30.99% / 33.99%) depending on account type; cash advances are commonly priced at a higher APR. Late fees can reach $40, returned payment fees up to $41, and a paper statement fee can apply unless e-statements are chosen.

The cash advance fee is $10 or 5% of the amount, whichever is greater. Synchrony discloses a Foreign transaction fee of 3% for non-USD or out-of-U.S. transactions. Frequent travelers may prefer a card with no foreign surcharge.

Person-to-person transfers funded by a card inside PayPal incur 2.90% + a fixed fee for domestic personal payments, which can erase net rewards; reserve credit-funded P2P for specific needs.

Eligibility and Documents to Prepare

PayPal credit card requirements include being at least 18 and a U.S. resident or territory resident, plus passing Synchrony’s credit review. A PayPal account is required to start and to redeem to a PayPal balance.

Keep full legal name, residential address, date of birth, Social Security number, annual income, mobile number, and email ready to streamline identity checks and e-consent.

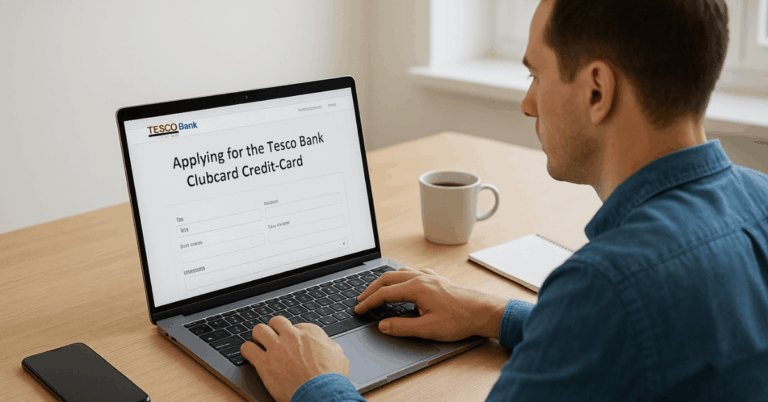

How to Apply Online

Applications are subject to credit approval; if declined, PayPal notes no impact to your credit score. Many approvals receive an instant virtual line usable at PayPal checkout.

- Sign in to PayPal → Wallet, locate PayPal Cashback Mastercard, and choose Apply to open the secure Synchrony page.

- Review rewards, rates, and fee disclosures carefully, including variable APRs and the Foreign transaction fee 3% line.

- Enter accurate personal and income details; consent to a credit check to enable a decision.

- Submit and review the result. Many decisions are made quickly; some applications are pending manual review.

- If approved, expect temporary virtual access for PayPal purchases immediately; add the card to PayPal mobile wallet and set autopay alerts before the physical card arrives.

After Approval: Setup and Daily Use

Begin with autopay enrollment and statement reminders to avoid interest and late fees.

Manage transactions and redeem at any amount through PayPal; a PayPal Balance account is needed to hold rewards in balance, otherwise transfer to a linked bank account or debit card.

Add the card to Apple Pay, Google Pay, or Samsung Pay for contactless in-store checkout.

How It Differs from PayPal Credit Card and PayPal Credit

The PayPal Cashback Mastercard focuses on uncapped cash-back rewards: 3% via PayPal checkout and 1.5% elsewhere, with no annual fee.

The PayPal Credit Card and the PayPal Credit digital line emphasize special financing (e.g., “No Interest if paid in full in 6 months” on qualifying purchases), and the Credit Card now works everywhere Mastercard is accepted.

Choose between everyday rewards or structured time to pay, based on budget discipline and upcoming purchases.

Pros, Cons, and Best Fit

Strong alignment appears when a large share of spending runs through PayPal checkout. The elevated rate can beat many flat-rate options for those categories, while 1.5% elsewhere provides a steady baseline value without category tracking.

Costs rise on international transactions because of the Foreign transaction fee 3%, and there’s no introductory 0% purchase APR, which reduces appeal for planned financing.

Overall fit improves when checkout habits deliberately select the card inside PayPal to trigger PayPal rewards 3%.

PayPal Cashback Mastercard

Alternatives to Consider

Shoppers wanting higher non-PayPal returns often pair or swap with flat-rate cards.

Citi Double Cash yields an effective 2% (1% when you buy + 1% as you pay) across purchases, while Wells Fargo Active Cash offers 2% with a $0 annual fee and periodic intro APR windows.

Rotating-category cards such as Chase Freedom Flex can deliver 5% in activated quarterly categories, and Chase Freedom Unlimited combines multiple elevated categories plus 1.5% elsewhere.

Customer Support and Headquarters

For servicing questions, use the PayPal customer service number specific to this card: 855-938-3684 (Synchrony Bank). Keep account details ready for faster authentication.

Formal correspondence for PayPal uses 2211 North First Street, San Jose, CA 95131, the company’s corporate headquarters listed in official materials. Card servicing and disputes remain with Synchrony.

Key Reminders and Safe Use

Selecting the PayPal Cashback Mastercard application inside Wallet ensures the right product and terms. Expect a hard inquiry if approved; if declined, PayPal indicates no impact to your score.

Avoid cash advances and card-funded P2P where fees overwhelm rewards. For a 3% earn rate, select the card as the funding source during PayPal checkout; ordinary swipes at merchants still earn 1.5%.

Conclusion

Frequent PayPal checkout turns this into a high-yield, no-maintenance option. Occasional PayPal users may extract more value from a broad 2% card or targeted category strategy.

If eligibility and budget fit, completing the PayPal Cashback Mastercard application online takes minutes, and virtual access usually activates the same day for PayPal purchases.

Compliance, Issuer, and Rate Notes

Issued by Synchrony Bank under the Mastercard network; program terms, benefits, and APRs vary by applicant and may change. Eligibility: 18+ and U.S. resident/territories; PayPal account required.