Applying for a credit card is easier when you know what to expect. The NatWest Reward credit card lets you earn cashback on daily purchases while keeping your finances organized.

It’s built for individuals who want flexible benefits and simple management through NatWest’s secure online platform. This guide walks you through features, requirements, and the full online application process.

Understanding the NatWest Reward Credit Card

Before applying, you need to understand what makes this card different. It’s designed for customers who spend regularly on groceries, fuel, and retail stores.

You can earn cashback automatically and manage everything through the NatWest app or online banking. The card also includes easy access to customer support, digital tools, and flexible repayment options.

Main Benefits Explained

The NatWest Reward Credit Card provides value for everyday spending. You’ll earn 1% cashback on supermarket spending and 0.25% on fuel and other purchases.

At selected MyRewards partner retailers, cashback can increase up to 15%. If you have a NatWest Reward current account, your £24 annual fee is refunded, making it even more cost-effective.

Additional Perks

The card supports contactless payments, secure mobile app access, and fraud protection technology. You can manage spending, redeem rewards, and view statements anytime.

They uses encryption and two-factor authentication for extra security. Overall, it’s a practical option for people who value convenience and rewards in one place.

Interest Rates and Fees

Understanding interest rates helps you manage costs effectively. The purchase rate is 25.9% p.a. (variable), and the representative APR is 31.0% (variable).

The assumed credit limit is £1,200, with an annual fee of £24 or £0 for Reward account holders. All rates depend on your credit assessment and financial situation.

Eligibility Criteria

Understanding eligibility helps you know if you qualify before applying. Meeting the requirements improves your approval chances and ensures a smooth process.

- Residency and Age: You must be a UK resident and at least 18 years old to apply.

- Income Requirement: A minimum annual income of £10,000 is needed for consideration.

- Credit History: A stable financial background and good credit score increase your chances.

- Verification: The bank will run a credit check as part of its assessment.

- Existing Customer Advantage: Having a NatWest current account can make approval faster.

- Responsible Borrowing: Managing debts and repayments well supports long-term credit health.

Rewards and Cashback Program

Understanding the reward system helps you maximize your spending benefits. The program is simple and offers flexible ways to use your earnings.

- Automatic Rewards: Every purchase adds to your MyRewards balance, which is viewable through the NatWest app.

- Flexible Redemption: Convert rewards into cash, apply them to your card balance, or donate them to charity.

- Real-Time Tracking: Cashback updates instantly, so you can easily monitor progress.

- High Cashback Opportunities: Earn up to 15% cashback at participating MyRewards partner retailers.

- Partner Stores: These include supermarkets, travel companies, and online merchants for everyday and special purchases.

- Better Value for Frequent Users: Regular spending at partner outlets increases your total cashback potential.

Security and Online Protection

NatWest prioritizes security for all cardholders. The credit card is protected by Fraud Detection Systems that monitor transactions 24/7. You’ll receive instant alerts for suspicious activity.

The mobile app also supports secure login using fingerprint or face ID. Purchases are protected under Visa or Mastercard’s zero liability policy.

This means you won’t be charged for unauthorized transactions. The card’s secure technology helps prevent online fraud and phishing. It’s an important safeguard for managing credit digitally.

Managing Your Card Online

Once approved, you can manage everything easily through NatWest’s online tools. The mobile app allows you to check balances, make payments, and track spending.

You can also set spending limits or receive alerts for transactions. These tools help maintain financial discipline. For desktop users, NatWest Online Banking offers full access to statements, rewards, and repayments.

Payment reminders can be automated to avoid interest charges. Managing your account digitally ensures full transparency. It’s ideal for people who prefer convenience and control.

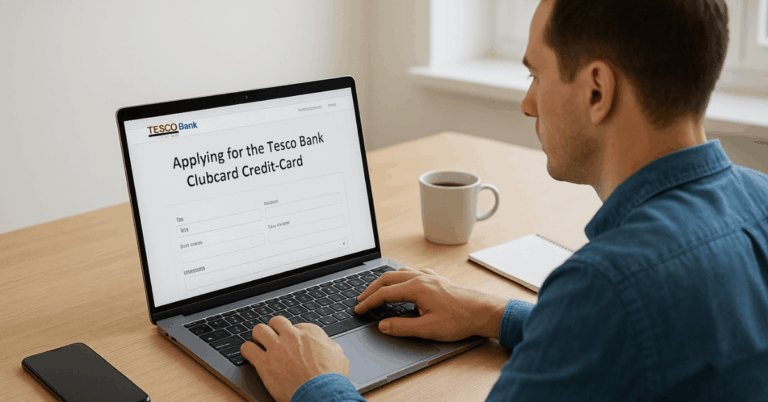

Application Process

Applying online is quick and secure. You can complete the entire process through the NatWest website or mobile app in just a few minutes. Below is a step-by-step list to guide you.

- Step 1: Choose your card. Visit the official NatWest Credit Cards page and select the Reward Credit Card from available options. Review the benefits and confirm that they match your spending habits.

- Step 2: Check your eligibility. Use the online eligibility checker before applying. It runs a soft credit search that doesn’t affect your score and gives a quick result.

- Step 3: Fill in your details. Enter your personal, employment, and financial information. Make sure everything is accurate to speed up approval.

- Step 4: Review and submit. Confirm your terms, check the representative example, and submit your application. You’ll receive an instant decision in most cases.

- Step 5: Receive your card. Once approved, the card will arrive by post within five to seven working days. Activate it via the NatWest app or website.

Tips Before You Apply

Knowing what to prepare before you apply can increase your approval chances. These points help you apply more confidently and make informed decisions.

- Check Your Credit Score: Use tools like Experian or Credit Karma to ensure your credit profile meets NatWest’s standards.

- Meet the Income Requirement: Confirm your annual income is at least £10,000 before applying.

- Avoid Multiple Applications: Too many credit requests can lower your score.

- Review Terms and Conditions: Read the full NatWest details to understand all fees and policies.

- Compare Card Options: Evaluate the Reward Credit Card against other NatWest cards like the Travel Reward or Credit Builder.

- Apply Responsibly: Choose the option that aligns with your financial goals and repayment ability.

Customer Support and Contact Details

You can contact NatWest Customer Service at 0345 788 8444 or internationally at +44 345 788 8444. Support is available from Monday to Friday, 8 a.m. to 8 p.m., and weekends from 9 a.m. to 6 p.m..

For mail inquiries, write to NatWest, 250 Bishopsgate, London EC2M 4AA. Visit www.natwest.com for online FAQs and secure chat assistance.

Pros and Cons

Understanding the pros and cons helps you compare effectively.

Pros:

- Earn cashback on all spending categories.

- Manage your account through the NatWest mobile app.

- Annual fee refunded for Reward current account holders.

- Secure transactions with fraud monitoring.

Cons:

- Higher representative APR than low-rate cards.

- Cashback mainly benefits frequent spenders.

- Requires a minimum income and a good credit history.

Responsible Credit Use

A credit card should support—not harm—your finances. Always pay at least the minimum amount by the due date to avoid late fees. Keeping balances low helps maintain a strong credit score.

Avoid overspending to stay financially secure. NatWest’s budgeting tools help monitor transactions and set spending limits.

Responsible usage ensures you enjoy long-term benefits and better credit eligibility. Manage payments carefully to maintain financial health and access future credit products.

Final Thoughts: Why the NatWest Reward Card Stands Out?

The NatWest Reward Credit Card remains one of the most practical cashback options in the UK. It combines convenience, digital control, and steady reward earnings for everyday users.

You can apply online in minutes, manage your account easily, and benefit from transparent rates. For anyone seeking a balance of rewards and reliability, it’s a solid choice.

Disclaimer: Terms, conditions, and rates can change without notice. Always confirm the latest details with NatWest before applying or using the card.