M&S Bank issues Mastercard-branded credit cards aimed at everyday spending, balance transfers, and rewards that convert into M&S vouchers.

You can complete the process entirely online, from a quick pre-check of eligibility through to submitting a secure application.

The bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

M&S Three Core Variants

Rewards Credit Card (earns points toward M&S vouchers).

Purchase Plus (longer 0% on new purchases).

Transfer Plus (longer 0% on balance transfers).

Pick the product that matches your goal—spending rewards, spreading the cost of new purchases, or moving an existing balance.

| Card | 0% on Purchases | 0% on Balance Transfers | Balance-Transfer Fee | Points & Vouchers | Other Notes |

|---|---|---|---|---|---|

| Rewards Credit Card | 9 months | 9 months (BTs made within 90 days) | 3.49% (min £5) | 5× points per £1 at M&S for first 6 months; then 1 point/£1 at M&S and 1 point/£5 elsewhere; 100 points = £1 voucher | Up to 55 days interest-free when you pay in full; app & online banking for PIN, SCA and alerts. |

| Purchase Plus | Up to 24 months | Up to 12 months (BTs within 90 days) | 3.49% (min £5) | 1 point/£1 at M&S; 1 point/£5 elsewhere; 100 points = £1 voucher | Offer tier varies by assessment (examples include 24/12, 24/9, or 15/9 months). Up to 55 days interest-free when you pay in full. |

| Transfer Plus | 3 months | Up to 30 months (BTs within 90 days) | 3.49% (min £5) | 1 point/£1 at M&S; 1 point/£5 elsewhere; 100 points = £1 voucher | Three APR/term tiers possible (e.g., 30/24.9%, 27/27.9%, 20/29.9%). Up to 55 days interest-free when you pay in full. |

M&S Bank Credit Card Application

Before applying, check that you meet typical UK criteria: you’re at least 18, resident in the UK, and able to pass standard affordability and credit checks.

M&S provides a soft-search eligibility checker so you can gauge your chances without affecting your credit score.

Have the following to hand: full name and contact details; three years’ UK address history; employment status, income, and main outgoings.

The bank may ask for identity documents or additional information to verify your application.

- Run the soft-search. Use the online eligibility checker to see your likelihood of approval and any indicative credit limit, without leaving a footprint on your report.

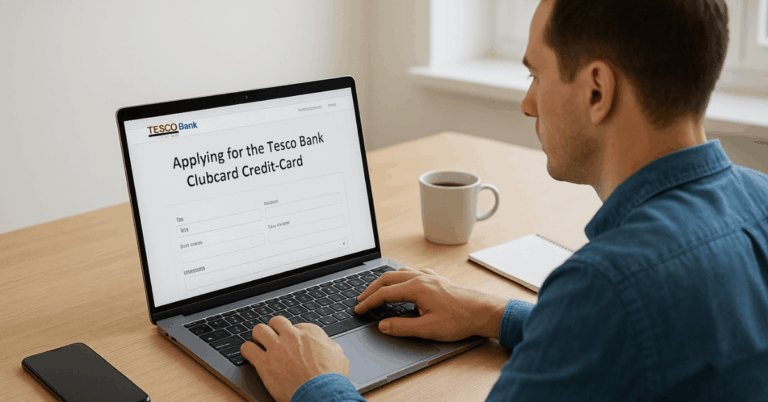

- Start the application. From your chosen card’s page, select Apply and complete the secure form. You’ll see pre-contract information (SECCI) and the credit agreement terms before you submit.

- Verification. M&S will run identity and credit checks. Some applicants are asked to upload electronic documents or answer brief follow-up questions.

- Decision and setup. If approved, you’ll receive your credit limit and terms. When the card arrives, activate it and register for Internet Banking or the M&S Banking App to view your PIN, confirm online purchases, set up alerts, and manage payments.

M&S Bank Credit Card APRs, Interest, and Fees

Representative examples published by M&S typically show:

- Rewards Credit Card: 23.9% APR representative (variable) with a 23.9% p.a. purchase rate (variable) and an assumed £1,200 limit.

- Purchase Plus / Transfer Plus: commonly 24.9% APR representative (variable); these may include time-limited promotional periods (e.g., 0% on purchases or balance transfers) and an indicative balance transfer fee of 3.49% (minimum £5).

- Standard charges include a cash advance fee of 2.99% (minimum £3), a non-sterling transaction fee of 2.99%, and typical £12 fees for late payment, over-limit, or returned payment. Interest on cash advances usually accrues from the transaction date.

Managing Your Account After Approval

Set up a Direct Debit (minimum, fixed amount, or full balance). Paying in full each month avoids purchase interest outside any promotional period.

If you opened the card for a balance-transfer deal, check the transfer window and factor in the transfer fee noted above.

Mobile and online servicing

With Internet Banking or the M&S Banking App, you can view your PIN, recent transactions, and statements.

Confirm online purchases using app-based authentication.

Set up spending or payment alerts and manage card controls.

Travel and cash use

If you use your M&S Bank Credit Card abroad, consider each cost.

For overseas spending, the 2.99% non-sterling fee applies to foreign-currency transactions.

For ATM withdrawals, expect the 2.99% cash fee (min £3) plus cash interest from the transaction date; the ATM owner may add its own fee.

Security and card issues

If your card is lost, stolen, or compromised, contact the 24/7 line below immediately.

You can also freeze or report the card via the app, then request a replacement.

Practical Tips for a M&S Bank Credit Card Smooth Application

Ensure income, employer details, and address history match your credit records to reduce verification friction.

Choose a Direct Debit option that fits your budget; paying in full saves interest when you’re outside any 0% period.

If you need a balance transfer, act on it promptly within the stated timeframe to secure the promotional rate.

Going over the limit can trigger a fee and may jeopardise any active promotional rate.

Contact Details

General enquiries & complaints: 0345 900 0900 (Text Relay available via 18001 + number).

Correspondence address: M&S Bank, PO Box 325, Wymondham, NR18 8GW

Registered office (legal): Marks & Spencer Financial Services plc, Kings Meadow, Chester Business Park, Chester CH99 9FB

Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Conclusion

Applying online for an M&S Bank Credit Card requires choosing the product that fits your needs, running the soft search, and submitting a secure application.

With mobile and online servicing, it’s easy to activate the card, set controls, and keep on top of payments.

If M&S rewards or a promotional period aligns with your plan, the card can be a practical fit for everyday spending and budgeting.

Disclaimer: Product features, eligibility criteria, APRs, fees, and promotional lengths change over time and may vary by applicant. Always rely on the live figures shown during your online application, and read your SECCI and Credit Agreement carefully before you sign.