Long-running 0% deals still matter when clearing costly card balances. The MBNA Long 0% Balance Transfer Credit Card targets those who need an extended 0% balance transfer period, clear repayment controls, and optional Smart Rewards cashback for everyday spending.

Early planning around fees, limits, and expiry dates keeps the offer working in your favor.

Key Facts for Barclaycard Platinum Balance Transfer

Short, verified facts help you check the headline economics quickly. Treat live issuer pages as final because promotional lengths and fees change without notice.

| Item | Current details |

| representative APR | 24.9% APR (variable). |

| 0% balance transfer period | Marketed “Long 0%”; third-party listings show up to 34 months. Confirm in journey. |

| balance transfer fee | Intro fee typically 3.49%–3.99% in first 60 days; 5% thereafter. |

| Purchase rate | 24.94% p.a. (variable); up to 56 days purchase interest-free if paid in full. |

| Annual fee | £0. |

Who This Card Suits

Debt consolidation works best when a long runway reduces interest to zero while repayments stay predictable.

Applicants planning to clear a large balance over many months benefit most, especially when previous cards charge high purchase APRs.

Those wanting simple admin also gain from moving multiple balances into one statement and setting a fixed monthly direct debit.

Rates, Fees, and How Charges Apply

Promotional transfers completed within the issuer’s window normally pick up the intro balance transfer fee, added to the transferred sum at posting.

Payments then reduce the highest-rate balances first under MBNA’s allocation rules; mixing purchases and transfers can complicate payoff order, so many borrowers reserve the account for transfers until cleared.

Purchase transactions can be interest-free for up to 56 days only when the full statement balance is paid by the due date; cash advances typically incur interest immediately plus fees.

Transfer Capacity

Transfer capacity usually tops out below the full credit limit to allow room for fees and any pending items.

MBNA’s guidance caps total transfers at 93% of the credit limit, and the minimum single transfer is £100. Expiry matters because any remaining balance switches to the standard balance-transfer rate after the promotional end date.

Eligibility and checks

Lenders assess balance transfer eligibility using identity, credit history, and affordability. MBNA lists baseline UK credit card requirements: age 18+, UK residency with three years’ address history, regular annual income, no recent CCJs/IVAs/bankruptcies, and no decline for an MBNA card in the last 30 days.

Comparison sites sometimes quote a typical minimum income around £14,000 for MBNA cards; treat that as indicative rather than binding because MBNA’s live journey is authoritative.

Running MBNA Clever Check provides a soft-search view of likely eligibility, available rates, and an estimated limit without affecting credit score. The tool speeds decisions and helps decide how much to transfer before any hard search.

How to Apply Online

Clear steps reduce errors and prevent delays. This sequence follows MBNA’s public process and aligns with typical data needs.

- Open the MBNA balance-transfer area and select Apply online after reading the key information.

- Run MBNA Clever Check to preview eligibility, indicative limits, and any promotional periods shown for your profile.

- Complete the secure form with personal details, three-year UK address history, employment, income, and bank account information.

- Add each non-MBNA card to transfer, including card numbers and requested amounts, then review the balance transfer fee and estimated completion timing.

- Submit the application, activate the card on arrival, and monitor the app for transfer status and offer expiry dates.

Repayment Strategy During the 0% Window

Best results come from a repayment amount that zeroes the balance before the promotional date. A fixed Direct Debit above the minimum protects the 0% status and prevents late-fee triggers that can forfeit promotions.

Statement cycling should be watched monthly for the transfer “offer ends on” line so any remaining balance can be cleared or refinanced ahead of reversion.

MBNA explains minimum-payment mechanics, and the summary box confirms loss of promos after missed minimums.

Comparisons and Market Context

MBNA’s “Long 0%” sits among the longest transfer windows in the UK, with reputable comparison sites showing up to 34 months on some profiles.

Competitors periodically match or exceed duration by a month while altering fees. Comparing both the length and the fee is more precise than chasing months alone because a smaller fee can offset a shorter term when your payoff plan is faster.

Features and Everyday Use

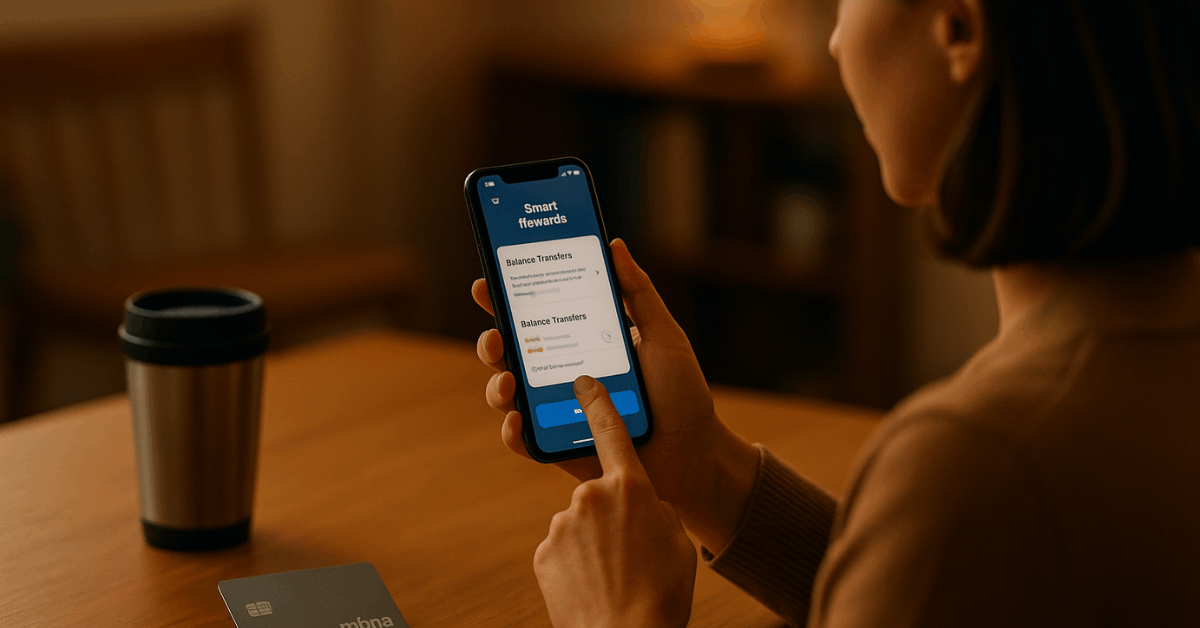

Everyday value comes from predictable rebates and frictionless payments that support consistent habits. Smart Rewards delivers targeted offers while wallet integrations streamline checkout and recordkeeping.

Set a routine to activate offers and track credits, then let automation handle receipts. Plan purchases after checking the offers hub to avoid missing high-value rebates.

Smart Rewards: Targeted Offers That Return Up to 15%

Activate Smart Rewards offers in the app or web account before paying at participating retailers. Expect returns up to 15% as statement credits are typically posted the following month after eligible transactions.

Check the offers hub weekly, prioritize limited-time or high-cap deals, and add reminders near recurring purchases.

Plan larger buys during active offers, then confirm the credit posted using statement search and tags. Keep receipts and screenshots of activated terms to support any missing-credit inquiries with customer service.

Wallets and Paperless Management for Faster Checkouts

Add the card to Apple Pay or Google Pay to enable secure tap-to-pay at compatible terminals. Tokenized numbers protect account details, while device biometrics authorize payments quickly without exposing the physical card.

Review paper-free statements inside the app, filter by merchant, and download monthly exports for budgets and audits.

Set alerts for large transactions and foreign charges, then reconcile credits against posted offers during month-end checks. Enable dispute workflows promptly when errors appear, uploading documentation so investigations proceed without delays.

Support and official details

Secure messaging in the MBNA app handles many account queries; telephony remains available for general credit-card support and fraud.

For UK cards, general contact includes 0800 015 0012 (lines typically 8 am–6 pm, seven days), while 0800 587 0997 handles fraud 24/7. MBNA Limited’s registered office is Cawley House, Chester Business Park, Chester CH4 9FB.

Conclusion

A long promotional runway, no annual fee, and optional Smart Rewards cashback make the MBNA Long 0% Balance Transfer Credit Card a strong candidate for structured debt consolidation.

Confirm the exact 0% balance transfer period, intro fee band, and transfer window in the live journey, then set a repayment schedule that clears the balance before reversion.

Responsible use protects the promotion and shortens the path back to interest-free everyday spending.