If you’re looking for a dependable credit card from a well-known UK bank, the Lloyds Bank Platinum Credit Card may be a solid option.

This guide explains who it’s for, what interest rates and fees apply, and how to complete your online application.

You’ll also find the official contact details, plus a short conclusion and disclaimer at the end.

About the Platinum Lloyds Credit Card

Lloyds Bank is one of the largest retail banks in the United Kingdom, offering a variety of credit cards designed for different financial needs.

The Platinum Credit Card is one of its flagship products, aimed at customers seeking low or promotional interest periods for purchases and balance transfers.

This card is ideal for individuals who prefer a credit product with online account management and reliable customer service.

Lloyds Bank also provides an eligibility checker that lets you see your chances of approval without affecting your credit score.

How Benefits Help You

The 0% introductory period allows you to make purchases (or transfer an existing balance) and pay no interest for the promotional period.

The online eligibility check keeps your credit score safe until you apply — important if you’re comparing cards.

Having a credit product from a well-known bank can strengthen your credit profile (if used responsibly).

Retailer offers and deals may provide added value beyond basic borrowing features.

Lloyds Platinum Credit Card Fees and Charges

Interest rates can vary depending on the specific Platinum version and your individual credit profile.

- Purchase rate: 24.94% variable per year (after any introductory offer ends).

- Representative APR: 24.9% APR variable.

- Promotional offers: Up to 21 months of 0% interest on purchases and up to 19 months of 0% interest on balance transfers.

- Balance transfer fee: Typically a small percentage of the transferred amount, applied at the start of the transfer.

- Minimum payment: Either 2.5% of the outstanding balance plus interest and fees or £5 — whichever is greater.

- Cash advance and foreign transaction fees: Additional charges apply, and interest is calculated from the date of the transaction.

These rates are subject to change and depend on your financial situation at the time of approval.

How to Apply for Lloyds Bank Platinum Credit Card

Applying for the Lloyds Bank Platinum Credit Card can be completed entirely online in a few easy steps.

Check Eligibility

Use the Lloyds Bank eligibility checker to see if you’re likely to be accepted. This step doesn’t impact your credit score.

Compare the Offer

Review your potential offer, including interest rates, credit limit estimates, promotional periods, and fees.

Prepare Required Information

Have your personal and financial details ready, such as income, employment status, and residential address.

You must be at least 18 years old and a UK resident.

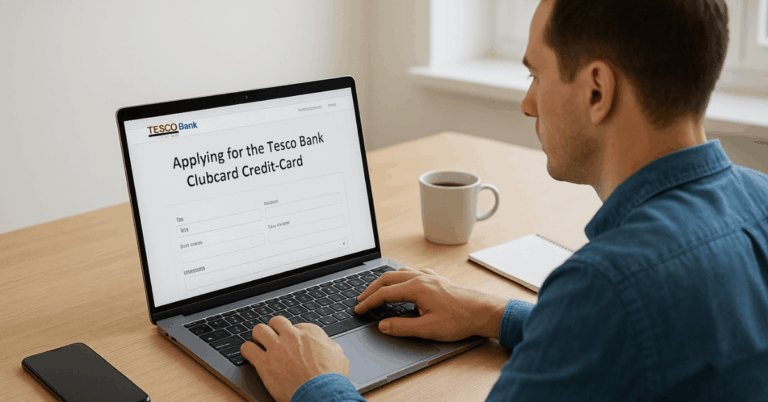

Submit the Application

Complete the application form on the Lloyds Bank website. After submission, the system performs a credit check and evaluates your eligibility.

Review and Accept the Terms

If approved, carefully read the terms and conditions before accepting the offer.

Pay attention to when the 0% promotional rate ends and what the standard rate will be afterward.

Activate and Manage Your Card

Once you receive your card, activate it through online banking or the Lloyds mobile app.

Set up alerts, enable online statements, and ensure you make at least the minimum monthly payments to maintain good credit standing.

Customer Support and Contact Information

General Enquiries (UK): 0345 300 0000

Existing Credit Card Customers: 0345 606 2172

Overseas Contact Number: +44 1733 347 007

Registered Office Address: Lloyds Bank plc, 25 Gresham Street, London EC2V 7HN

Managing Your Platinum Lloyds Bank Card

Once approved, you can manage your Lloyds Bank Platinum Credit Card through online banking or the Lloyds mobile app.

These platforms let you view balances and recent transactions in real time, set up direct debits or one-time payments, and receive spending notifications.

You can also manage your card limits and freeze your card if necessary.

Responsible use of the online and mobile tools helps you stay on top of payments and avoid unnecessary interest or late fees.

Considerations

The promotional period ends, and after that the standard interest rate applies — so it’s best to plan how you’ll use the card.

You still must make at least the minimum payment each month to maintain the benefits and avoid penalties.

Some perks (retailer offers, cashback, etc.) may require registration and may come with conditions (eligibility, online banking, etc.).

Even though this variant may have no annual fee, other versions might — so check your specific offer details.

Lloyd Cards Comparison

Here’s a comparison of several credit cards from Lloyds Bank, showing how the Lloyds Bank Platinum Credit Card version stacks up against other options.

| Card Name | Representative APR / Key Rates | Introductory Offer | Annual / Monthly Fee | Target Use Case |

|---|---|---|---|---|

| Platinum (Standard) – “Platinum Credit Card” | ~24.9% APR variable. Standard purchase rate ~24.94% p.a. after any intro period. | Sometimes up to ~21 months 0% on purchases & up to ~19 months 0% on balance transfers (for specific variant) | £0 (for many versions) | If you want a mainstream card with a decent intro deal and no rewards programme. |

| “Platinum 0% Purchase & Balance Transfer” | Representative APR ~24.9% variable. | Up to ~21 months 0% on purchases, up to ~19 months 0% on balance transfers. | £0 | Good if you plan new purchases + want to transfer an existing balance, and want a 0% period. |

| “Platinum Low Rate” | Example purchase rate ~10.94% variable (representative APR ~10.9%) | Some 0% fee on balance transfers if done in first 90 days (for specific version) | £0 | Ideal if you plan to carry a balance (though ideally you pay in full) and want lower interest rather than long 0% period. |

| “World Elite Mastercard®” | Purchase rate ~22.94% variable; Representative ~55% APR (this arises because monthly fee is involved) | No specific long 0% offer mentioned; premium benefits instead. | £15 per month (£180 per year) | Tailored for frequent travellers or people wanting premium travel perks and cashback, willing to pay the fee. |

Conclusion

The Lloyds Bank Platinum Credit Card offers competitive introductory rates and flexible management tools backed by one of the UK’s most established banks.

Applying online is quick and secure, giving you an immediate response on your eligibility.

Always read the full terms and conditions before applying, and use credit responsibly.

Disclaimer: This article is for informational purposes only and should not be taken as financial advice. Card terms, interest rates, and promotional offers may change at any time. Approval and credit limits depend on your personal financial circumstances and the bank’s assessment criteria. Always review the latest information on Lloyds Bank’s official website before submitting your application.