The Halifax Clarity Credit Card removes non-sterling purchase fees and doesn’t add a separate ATM withdrawal fee, so everyday spending overseas stays simple.

Interest rules still matter, especially for cash, and a few setup steps will help protect your credit score and keep charges low. The guide below covers benefits, rates, eligibility, application, comparisons, and official contact details.

Why Halifax Clarity is Popular for Travel

Hidden overseas markups drain budgets fast. Clarity avoids no foreign transaction fees on purchases and doesn’t add a Halifax cash withdrawal fee, so transactions convert at the card-scheme rate rather than an extra card surcharge.

Interest on cash advances starts the day the money is taken, therefore quick repayment is essential to limit cost. Clarity also includes everyday features useful at home: in-app card controls, contactless and mobile wallet support, spending alerts, and paper-free statements.

Section 75 protection may apply to qualifying purchases between £100 and £30,000, which helps when booking flights or accommodation.

Rates, Interest, and Fees Explained

No annual account fee is typical for this card, preserving long-term value for occasional and frequent travellers.

Purchases can avoid interest when the full statement balance is paid on time; cash begins accruing interest immediately after withdrawal, because there’s no grace period for cash transactions.

Exchange rates on overseas payments follow the Visa or Mastercard rate of the day. Clarity runs on the Mastercard network and enjoys broad global acceptance.

Practical Ways to Minimise Costs Abroad

Pay the terminal in local currency to avoid dynamic currency conversion markups. Keep ATM use for genuine needs; when cash is necessary, make an extra payment mid-cycle so interest days stay low.

Set spending and due-date alerts in the Halifax app and add a Direct Debit for the full balance to avoid late-fee surprises.

Eligibility and Documents

Applying when prepared helps protect your credit score and speeds up a decision.

Halifax offers a soft-search eligibility checker showing the cards you’re likely to be accepted for, your estimated limit, and your likely representative APR, without impacting your file.

Provide complete, accurate information, and apply only when ready to avoid unnecessary hard searches.

Who Can Apply

Applicants must be UK residents aged 18+ with a regular income, free of bankruptcies, IVAs, or CCJs, not unemployed or students, and not declined by Halifax within the last 30 days.

What to Prepare

Have the last three years of UK address history, income and employment details, and other committed outgoings ready. Accuracy helps the lender verify identity and affordability quickly.

What Affects the Decision

Credit history, existing borrowing, stability of employment, and time at address are assessed. Using the soft-search first limits unnecessary hard checks; setting a Direct Debit after approval reduces the chance of missed payments.

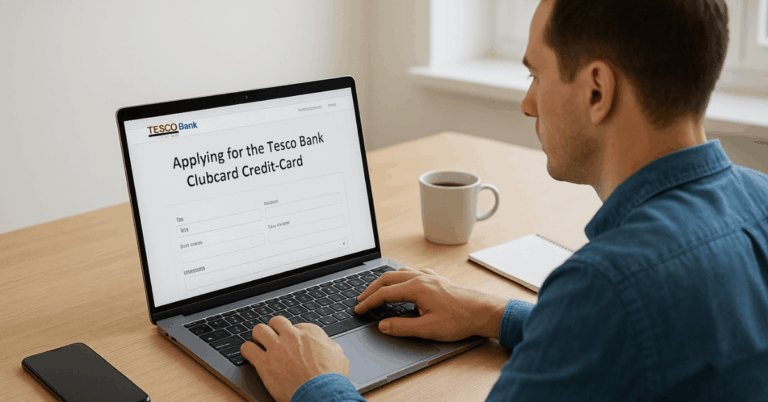

How to Apply Online: Step-By-Step

A short workflow keeps the process straightforward while protecting your score.

- Run the Halifax eligibility checker for a personalised likelihood, rate, and limit; this uses a soft search only.

- Review the card offer details shown, including any promotions.

- Complete the full application and submit; a hard search occurs at this stage.

- After approval, activate the card, add it to mobile wallets, and set a Direct Debit for the full balance.

- Switch on app notifications for spending, international transactions, and payment due dates.

Clarity vs Other UK Travel Cards

Choosing the best travel credit card depends on how often you spend abroad, whether cash is needed, and whether rewards or a monthly fee suit your pattern. Always confirm current terms because card pricing changes over time.

Halifax Clarity vs Barclaycard Rewards

Both remove non-sterling purchase fees; Barclaycard Rewards also advertises no fees for overseas ATM withdrawals and pays 0.25% cashback on eligible spend.

That combination can appeal if rewards matter and balances are cleared monthly. Preference for Halifax’s app experience and fee-free cash withdrawals (from Halifax’s side) keeps Clarity compelling for simple pricing.

Halifax Clarity vs Virgin Money Travel Credit Card

Virgin Money’s travel card removes non-sterling purchase fees; however, a cash advance fee applies to ATM withdrawals (typically 3% on the Travel Card; 5% on many others).

Clarity does not add a separate Halifax cash-withdrawal fee, making emergency cash cheaper on fees before interest, provided repayments are made quickly.

Halifax Clarity vs Santander All-in-One Credit Card

Santander All in One removes foreign exchange fees on purchases abroad and pays a flat 0.5% cashback, but charges a monthly fee (£3 at the time of writing).

Heavy travellers with high spend may offset the fee; occasional travellers often prefer Clarity because there’s no ongoing account fee to justify.

Everyday Features that Add Control

Contactless, chip-and-PIN, and compatibility with major digital wallets enable quick checkout worldwide.

Full online account management, spend alerts, and card-freeze options increase security. Halifax highlights UK call centres and paper-free statements for convenience.

Section 75 protection can cover eligible single-item credit card purchases over £100 and up to £30,000, including certain purchases made outside the UK; consider this valuable when booking flights, tours, or hotels.

Key Risks to Watch

Some ATM owners levy their own fee, displayed on-screen before confirming the withdrawal.

Interest on cash starts the day of withdrawal, so early repayment limits the cost. If the full statement balance isn’t cleared, purchase interest will also be charged unless a promotional rate applies.

Official Contacts and Support

For Halifax credit card servicing in the UK, call 0345 944 4555; from overseas, call +44 1733 573 189.

For lost or stolen cards or card fraud, call 0800 015 1515 in the UK or +44 113 242 8196 from abroad. App and online banking also support reporting and replacement requests.

Halifax Main Office and Regulation

Halifax is a division of Bank of Scotland plc, part of Lloyds Banking Group. The registered office of Bank of Scotland plc is The Mound, Edinburgh, EH1 1YZ.

The bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

The registered office isn’t a customer-service desk; use phone and digital channels for account queries.

Conclusion

Clarity keeps international spending straightforward: no foreign transaction fees on purchases and no Halifax cash-withdrawal fee, paired with clear interest rules that reward on-time full repayments.

Solid app controls, Section 75 protection, and transparent support make it an easy travel credit card to manage daily and abroad.

Run the soft-search eligibility checker, review your personalised representative APR and limit, then apply when ready. Terms and rates can change; always confirm details on Halifax’s site before use.