The Citibank Credit Card offers a secure and straightforward way to manage your daily spending while earning rewards.

You can apply online for free, making the process fast and accessible to anyone who meets the requirements.

This guide will show you how to apply, understand the interest rates, and use your card wisely to avoid extra fees.

Eligibility Requirements

Before you apply for a Citibank credit card, you need to meet some basic criteria. These help ensure you can handle the card’s responsibilities.

Below are typical eligibility requirements.

- Minimum Age: You must be at least 21 years old to apply for a Citibank Credit Card.

- Residency Status: You must be a resident of the country where you are applying or hold valid legal status if you are a non-citizen.

- Income Source: You must have stable employment or a consistent source of business income.

- Minimum Income Requirement: You must meet the minimum annual income threshold set by Citibank in your country.

- Identification: You must provide a valid government-issued ID and a proof of address such as a utility bill or lease contract.

- Credit Standing: You should have a fair to good credit history with no record of serious defaults or late payments.

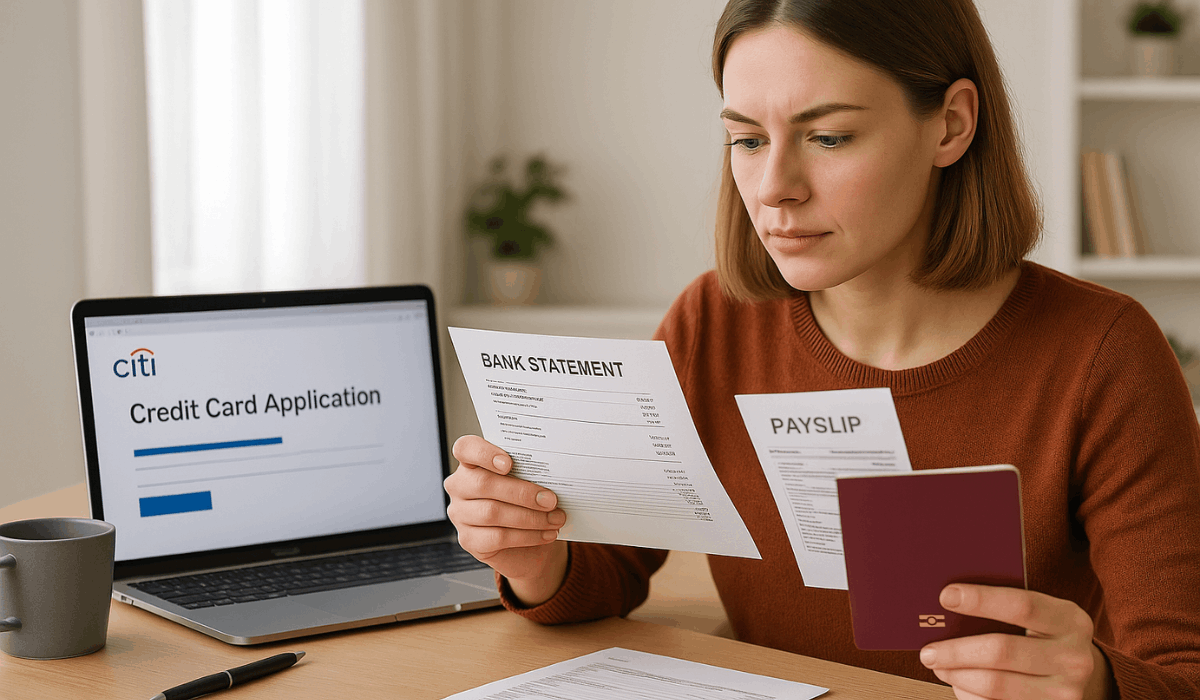

Required Documents

You’ll need to prepare specific documents before submitting your application. Having them ready ensures the process goes smoothly.

Below are the common required documents.

- A valid government-issued photo ID (e.g., passport, driver’s licence, national ID).

- Proof of income (pay slip, Certificate of Employment, bank statement showing salary credits).

- Proof of address (utility bill, lease contract, or similar).

- Filled out the application form with your personal and employment details.

- For self-employed individuals: business registration or tax documents.

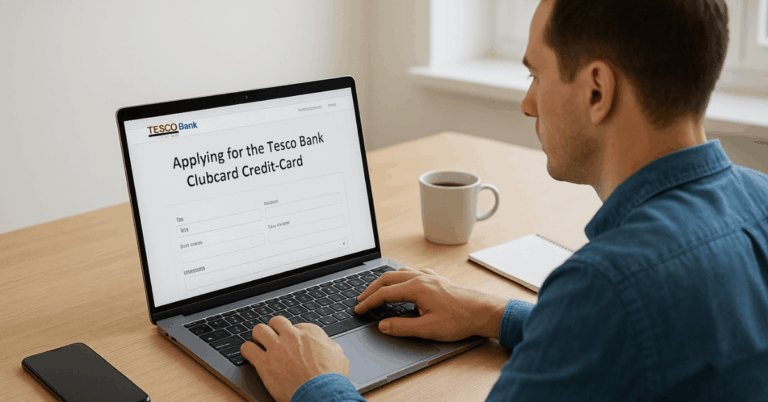

Step-by-Step Application Process

Applying for a Citibank credit card is straightforward if you follow each step carefully.

You’ll need your documents ready and apply either online or through a branch. Below is a general process you can follow.

- Visit Citibank’s official website and go to the “Credit Cards” section.

- Choose the specific credit card product you want (with the rewards/benefits you prefer).

- Click on “Apply Now” or a similar button to begin the online application form.

- Fill in your personal information (name, address, contact details), employment/income details, and other required fields.

- Upload or submit the necessary documents (ID, proof of income, proof of address) as per the card’s requirements.

- Review all your entries for accuracy and completeness. Then submit the application.

- Wait for approval. The bank reviews your application and may ask for additional information.

- If approved, activate your credit card once you receive it (via mail or electronically) and set up online banking/alerts.

- Start using your card responsibly: know your credit limit, payment due dates, and avoid unnecessary fees.

Interest Rates & Fees

Interest rates and fees apply when you carry a balance, miss a payment, or use extra services.

Knowing these charges helps you manage your account wisely and avoid unnecessary expenses.

- Purchase APR: ~ 18.24% to 28.24% (variable) for many U.S. cards.

- Introductory APR: Some cards offer 0% for 12–15 months on purchases or balance transfers.

- Cash advance APR: For example, up to ~29.49% on a U.S. student-card offer.

- Balance transfer fee: E.g., 3% of each transfer (plus minimum) in the U.S. markets.

- Annual membership/fee: Range from $0 (no annual fee) to premium amounts depending on card tier.

Application Tips for Approval

Applying for a Citibank credit card requires accuracy and preparation.

These key tips help you strengthen your application and avoid common mistakes that can lead to rejection.

- Credit Score: Check your credit score and ensure it meets Citibank’s standards before applying.

- Accurate Income: Provide correct and updated income details supported by payslips or bank statements.

- Single Application: Apply for one card at a time to prevent lowering your credit rating.

- Stable Contact Info: Use a valid and active address, phone number, and email for easy verification.

- Low Debt Ratio: Keep your existing credit usage low to show responsible financial behavior.

- Verified Documents: Upload clear, complete copies of required documents to avoid delays.

- Good Payment History: Maintain consistent, on-time payments on other accounts to boost credibility.

After Approval – What Happens Next

Once your credit card is approved, there are a few essential steps you’ll need to complete before you can start using it.

Understanding what happens next helps you activate your card correctly and manage your account from the start.

- Card Delivery: Your Citibank credit card arrives by mail within a few business days or through instant digital access in the Citi Mobile App.

- Card Activation: Activate it online, by phone, or through the mobile app to start using it safely.

- Set Up Online Access: Register on Citibank Online to track spending and make payments easily.

- Receive Your PIN: Your PIN is sent separately or created in the app for secure transactions.

- Review Credit Limit: Check your credit limit and manage spending to maintain good standing.

- Start Earning Rewards: Use your card to earn cashback, miles, or reward points instantly.

- First Billing Cycle: Review your first statement to know payment dates and interest details.

Rewards, Benefits & Extra Features

Citibank credit cards come with valuable perks that make everyday spending more rewarding.

These benefits vary by card type but generally help you save money and enjoy premium privileges. Here are some of the most common features.

- Cashback Rewards: Earn a percentage of your purchases back as cash credits on select cards.

- Travel Miles: Collect miles for flights and hotel stays through partner airline programs.

- Reward Points: Accumulate points for every purchase and redeem them for gift items or vouchers.

- Installment Plans: Convert large purchases into easy monthly payments with low interest.

- Exclusive Discounts: Enjoy special deals at restaurants, shops, and online merchants worldwide.

- Travel Protection: Get insurance coverage for trip cancellations, lost baggage, or travel accidents.

- Digital Access: Manage your account through the Citi Mobile App with real-time notifications.

- Balance Transfer Option: Move existing card balances to your Citibank card for lower interest.

- Contactless Payments: Tap your card for fast and secure transactions anywhere contactless is accepted.

Contact Information

If you need help with your Citibank credit card, you can reach customer service through several convenient channels.

Keep your card and ID ready when you contact them for faster assistance.

- Citi Cards (U.S.) — General Support: 1-800-950-5114. For TTY, use 711 or other relay services

- Citi Cards (U.S.) — Spanish: 1-800-947-9100

- Outside the U.S. (call collect): +1-605-335-2222 (ask the operator for “Citi”). It is available 24/7.

- Citibank Singapore — CitiPhone (general): +65 6225 5225 (agent support hours listed on site).

- Citibank Singapore — Fraud Hotline: +65 6337 5519 (24-hour card emergency per site).

- Official Website: citi.com → Credit Cards → Contact Us / Help for country-specific numbers and secure messaging.

- Citi Mobile® App: Use in-app chat/secure message for account-specific assistance.

To Conclude

The Citibank Credit Card offers convenience, security, and valuable rewards for everyday spending.

By understanding the requirements and completing the free online application, you can start managing your finances more effectively.

Apply now through the official Citibank website to enjoy exclusive benefits and flexible payment options.

Disclaimer

Information about Citibank credit cards, including rates and fees, may change without prior notice.

Always check the official Citibank website or your local branch for the most up-to-date terms and conditions before applying.