Applying for your Citibank Card online is quick, secure, and convenient.

You can complete the process from your phone or computer without visiting a branch.

With flexible features, competitive rates, and strong security, Citibank makes credit card ownership easier than ever.

Benefits of Applying Online

Applying online for your Citibank Card saves you time and effort. You can complete everything from the comfort of your home with a few simple steps.

Here are the main benefits you’ll enjoy when applying online:

- 24/7 Access: Apply anytime using your phone, tablet, or computer.

- No Branch Visit: Skip long lines and paperwork.

- Faster Approval: Online applications are processed within a few days.

- Secure System: Citibank uses encryption to protect your information.

- Instant Confirmation: Receive updates through email or SMS.

- Easy Tracking: Check your application status online anytime.

- Paperless Process: Upload documents digitally for faster processing.

Card Features You’ll Enjoy

Citibank Cards come with features that make daily spending more rewarding and convenient.

Whether you use your card for shopping, travel, or online payments, you’ll benefit from useful tools and exclusive privileges. Here are the key features you’ll enjoy:

- Rewards and Cashback: Earn points or cashback on every eligible purchase.

- Contactless Payments: Tap to pay quickly and securely at stores worldwide.

- Global Acceptance: Use your card anywhere Visa or Mastercard is accepted.

- Mobile Banking Access: Manage your card through the Citibank app anytime.

- Fraud Protection: Get alerts and zero-liability coverage on unauthorized transactions.

- Exclusive Promotions: Enjoy special deals, discounts, and dining privileges.

- Flexible Payment Options: Choose between full or partial monthly payments.

Interest Rates and Fees

Understanding the rates and fees helps you avoid surprises and manage your card wisely.

Below are the common charges and interest rates tied to online card applications.

- Purchase APR: Approximately 18.74% to 28.74% in USD for standard cards

- Cash advance APR: Around 29.49% in USD

- Penalty APR (if you miss payments): Up to about 29.99% in USD

- Balance transfer rate (if offered): Similar to purchase APR range (from about 18.74% in the U.S. context).

- Annual fee: Varies widely by card type—Some cards have $0 in the U.S., others may charge higher annual fees.

- Foreign transaction / international usage fee: Some cards waive it, others apply a fee (check your country’s terms).

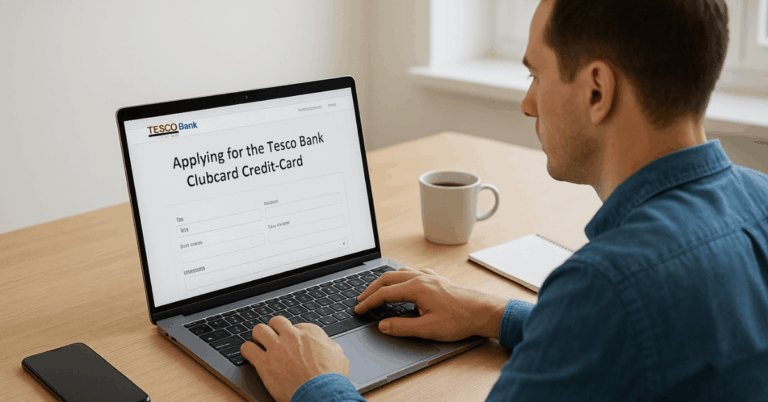

Step-by-Step: How to Apply Online

Applying for your Citibank Card online is convenient and straightforward. You can finish the process in a few minutes using your computer or mobile device.

Follow these steps to get started:

- Step 1: Visit the Official Citibank Website – Go to the Citibank homepage and find the credit cards section.

- Step 2: Choose Your Card Type – Review the available options and pick the one that fits your lifestyle and spending habits.

- Step 3: Click “Apply Now” – Begin your application by selecting the “Apply Now” option under your chosen card.

- Step 4: Fill Out the Form – Provide accurate details such as your name, address, employment, and income.

- Step 5: Upload Required Documents – Attach clear copies of your identification and proof of income.

- Step 6: Review Before Submitting – Double-check that all information is correct.

- Step 7: Submit and Wait for Confirmation – After submission, Citibank will notify you by email or text once your application is received or approved.

Requirements for Application

Before you start your online application, make sure you have your personal and financial details ready.

These help Citi verify your identity and assess whether you qualify. Meeting these requirements improves your chance of a smooth approval.

- Full legal name, date of birth, and current mailing address

- Social Security Number (SSN) or other taxpayer ID where required

- Employment status and annual income (gross or net) to show you can manage credit

- Good credit history (or appropriate credit profile, depending on the card)

- Physical address (not a P.O. Box) and contact information (phone/email) for communication

After You Apply

After submitting your application, the review process begins. The bank verifies your information and checks your eligibility before making a decision.

Here’s what usually happens next:

- Application Review: Citibank evaluates your credit history, income, and provided details.

- Verification Process: You may be contacted for additional documents or identity confirmation.

- Approval Notification: If approved, you’ll receive a confirmation via email or text.

- Card Delivery: Your new card is mailed to your registered address within a few business days.

- Card Activation: Follow the instructions to activate your card online or by phone.

- Start Using Your Card: Once activated, you can make purchases, earn rewards, and manage your account online.

Tips for a Smooth Application

A few simple habits can make your Citibank Card application faster and more successful.

Paying attention to small details helps you avoid delays or rejection. Here are practical tips to ensure a smooth application:

- Double-Check Your Information: Make sure all personal and financial details are accurate before submitting.

- Use Updated Documents: Upload clear, current copies of your ID and proof of income.

- Maintain a Good Credit Record: Pay existing debts on time to show financial responsibility.

- Avoid Multiple Applications: Submitting several credit applications at once can lower your approval chances.

- Ensure Stable Income: Provide consistent employment or income information to support your eligibility.

- Use an Active Contact Number and Email: Citibank uses these for verification and updates.

- Apply During Business Hours (If Possible): It may help speed up processing and verification.

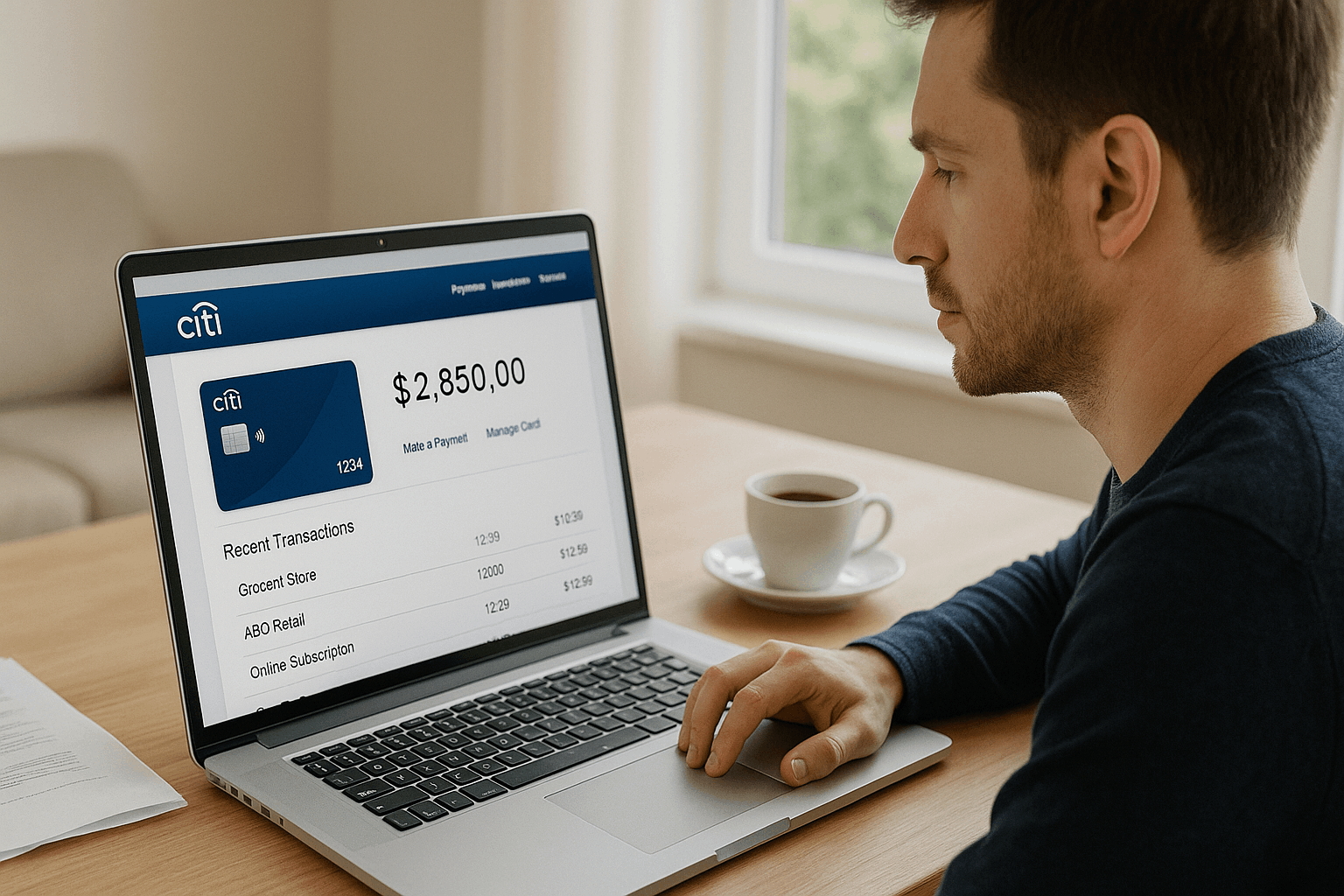

Managing Your Citibank Card Online

Once your card is approved, managing it online is easy and efficient. You can track spending, pay bills, and control security settings anytime.

Here are the main ways to manage your card online:

- Check Your Balance and Transactions: Log in to your Citibank account to view your current balance, recent purchases, and payment history.

- Make Online Payments: Pay your monthly bill directly from your linked bank account through the Citibank platform.

- Set Up Alerts: Enable email or SMS notifications for transactions, due dates, and suspicious activity.

- Monitor Rewards: Track earned cashback or reward points and redeem them for purchases or travel.

- Control Card Settings: Temporarily lock your card, change your PIN, or update limits using the online dashboard or mobile app.

- Download Statements: Access digital monthly statements anytime for recordkeeping.

- Update Personal Information: Keep your contact details current to avoid issues with notifications or delivery.

Customer Support and Contact Information

Here are key contact options for reaching customer support at Citibank.

Save the ones relevant to your region and account type so you can get help quickly when you need it.

- U.S. general credit-card support: 1-800-950-5114

- U.S. banking account support: 1-888-248-4226

- International/emergency contact: From outside the U.S., call 1-212-422-8847

- TTY (hearing impaired) for U.S. customers: 711 or other relay service

- Online support and country-specific contacts: Visit the “Contact Us” section on Citi’s website and select your country for the correct local numbers

- Wealth/Private clients: 1-888-500-5008 for U.S. Citigold clients

The Bottomline

Applying for your Citibank Card online gives you speed, security, and flexibility.

You can manage your card, earn rewards, and make global payments from anywhere.

Start your application today through the official Citibank website and enjoy smarter banking with worldwide benefits.

Disclaimer

All details about rates, fees, and card features are subject to change based on Citibank’s latest policies and regional terms.

Always review the official Citibank website or contact customer service for the most current and accurate information.