There are many travel-rewards credit cards with solid benefits and a straightforward online application.

The Chase Sapphire Preferred® Card from JPMorgan Chase Bank, N.A. is one to consider.

Below is a clear, verified guide on how to apply online, including rates, fees, contact details, and other key facts.

What the Card Offers

You’ll benefit from the Chase Sapphire Preferred® Card by earning extra points when you travel or dine, making your spending work harder.

- Earn 5× points on travel purchased through Chase TravelSM.

- Earn 3× points on dining worldwide (including eligible delivery and take-out).

- Earn 3× points on online grocery purchases (excluding Target, Walmart, and wholesale clubs).

- Earn 3× points on select streaming services.

- Earn 2× points on other travel purchases (outside of travel booked via Chase Travel).

- Earn 1× point per dollar on all other purchases.

- Receive a $50 annual hotel credit (statement credit) when you book hotel stays via Chase Travel.

- 10% anniversary point bonus: Each account anniversary year, you earn bonus points equal to 10% of your total purchases in the prior year.

- Transfer your points 1:1 to several travel loyalty partners (airlines and hotels) for greater flexibility.

You gain flexibility because you can transfer points to various travel partners and redeem them for better value when booking travel.

The card includes travel-protections like rental-car damage coverage and trip-cancellation insurance.

You also get automatic access to premium partner offers such as a hotel-credit and dining perks, plus no foreign transaction fees.

How to Apply for the Chase Sapphire Preferred Card Online

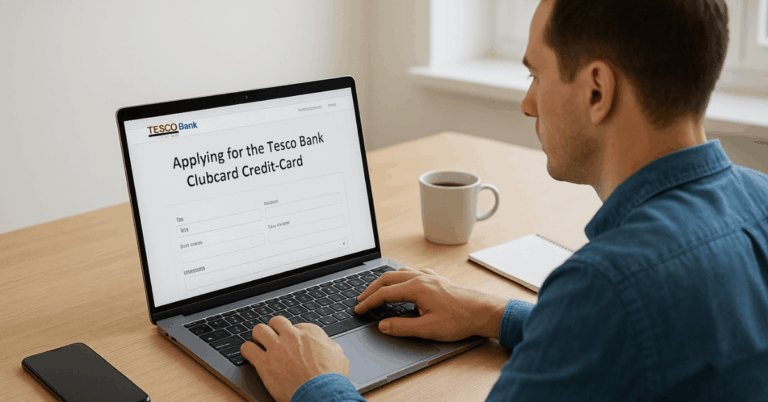

Visit Chase’s official website and navigate to the credit cards section. Locate the Chase Sapphire Preferred Card page.

Click “Apply Now.” Provide the required personal information, such as your full name, date of birth, address, employment status, income, and SSN.

Submit your application. Some applicants receive instant decisions, while others may need to provide additional information.

If approved, you’ll receive your card by mail. You can often start using it digitally via Apple Pay or Google Pay before the physical card arrives.

Eligibility & Application Tips

Maintain a good to excellent credit score (typically 690 or higher).

Ensure that your income and employment information are accurate and current.

Avoid submitting multiple credit card applications in a short period, as this can lower your approval odds.

Read all offer details carefully, including bonus spending requirements, if applicable.

Contact Information & Bank Address

If you need help during or after your application, you can reach Chase through the following.

Customer Service (Personal Credit Cards): 1-800-432-3117

General Correspondence Address: J.P. Morgan Chase Bank, N.A. Mail Code LA4-6475 700 Kansas Lane Monroe, LA 71203

Payment Mailing Address: Cardmember Services P.O. Box 6294 Carol Stream, IL 60197-6294

Rates & Fees Summary

Below are the verified numbers provided by Chase:

- Annual Fee: $95

- Purchase APR (Variable): 19.74% to 29.99%

- Balance Transfer APR: Typically, the same as the purchase APR range

- Penalty APR: Up to 29.99% if you miss payments

- Grace Period: At least 21 days when you pay your balance in full

- Cash Advance Fee: Either $10 or 5% of the transaction amount, whichever is greater

- Foreign Transaction Fee: None

After You Apply

If approved, you’ll be notified of your credit limit and can activate your card upon arrival.

If pending, Chase may contact you for additional verification or income details.

After activation, pay attention to your billing cycle and due dates to avoid interest charges.

Use Chase Ultimate Rewards to redeem your points efficiently and maximize travel or cashback value.

Key Considerations Before Applying

Can you pay your balance in full every month to avoid interest charges?

Will the rewards and benefits offset the $95 annual fee based on your travel and dining habits?

Do you already hold another Chase Sapphire card (as Chase restricts multiple Sapphire cards)?

Have you reviewed all fees and terms on the official website before proceeding?

Chase Cards Comparison

Here’s a comparison of three popular JPMorgan Chase Bank, N.A. cards. Use it to figure out which fits your spending habits best.

| Feature | Chase Sapphire Preferred | Chase Sapphire Reserve | Chase Freedom Unlimited |

|---|---|---|---|

| Annual Fee | $95 | $550 (or higher depending on promotional changes) | $0 |

| Rewards Rates (typical) | Strong travel/dining categories. | More premium travel/dining rewards and perks. | Good base rate + bonus categories. |

| Target User | Someone who travels/dines reasonably often but doesn’t want very high fee | Frequent traveler who will use premium perks to justify higher fee | Everyday spending + lower fee (or no fee) card |

| Travel Perks & Transfers | Yes — travel partners, bonus categories. | Premium perks (lounge access, higher credits) | More limited travel perks; focuses on cash-back/points for general use |

If you don’t travel extremely frequently, the Sapphire Preferred gives a good balance of benefits vs fee.

If you travel a lot and will use lounge access, elite statuses, high credits, then the Sapphire Reserve might make sense despite its high fee.

If you are more about everyday purchases, want a no-annual-fee card, and travel less, the Freedom Unlimited is a very strong complement.

Pros and Cons

Pros

- Strong sign-up bonus and bonus point-earning in travel and dining categories.

- Access to valuable 1:1 point transfers to many airline and hotel loyalty programs.

- No foreign transaction fees, making it good for international use.

- The annual fee ($95) is relatively modest compared to many premium travel cards.

Cons

- Annual fee ($95) still applies—so you need to use the benefits enough to justify it.

- Requires good to excellent credit to qualify for.

- Lacks some premium perks found on higher-end travel cards (e.g., airport lounge access, +TSA PreCheck/Global Entry credit).

Conclusion

Applying online for the Chase Sapphire Preferred® Card is very secure. The process can be completed in minutes, and approval often happens the same day.

With an annual fee of $95 and a variable APR of 19.74% to 29.99%, the card remains a strong option for travelers and diners who pay their balances.

Before applying, ensure that the rewards, rates, and fees align with your lifestyle and financial goals.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Terms, conditions, APRs, and offers for the Chase Sapphire Preferred® Card are subject to change. Approval depends on creditworthiness and other criteria established by J.P. Morgan Chase Bank, N.A. Always review the most current information directly with Chase before applying or making financial decisions.