The Chase Freedom Flex Credit Card gives you flexible rewards and a zero annual fee.

You can apply entirely online with just a few documents and minutes of your time.

Before applying, it helps to understand its features, eligibility, and current rates so you can decide if it fits your spending habits.

Card overview

The Chase Freedom Flex® features no annual fee and offers a mix of fixed and rotating reward categories that let you earn up to 5% cash back.

Key Features

The following are the main features of the card, allowing you to easily see what it offers and decide if it fits your spending habits.

- Earn 5% cash back on up to $1,500 in combined purchases each quarter in rotating bonus categories that you must activate.

- Earn 5% cash back on travel booked through the Chase Travel portal.

- Earn 3% cash back on dining—including take-out and eligible delivery services.

- Earn 3% cash back on purchases at drugstores.

- Earn 1% cash back on all other purchases.

- No annual fee.

- Rewards (cash back) do not expire as long as your account remains open.

- Various added benefits (e.g., purchase protection, cell-phone protection) are available when you use the card for eligible purchases.

Interest Rates & Fees

Knowing the current interest rates and fees helps you plan your credit use and avoid surprises.

Here’s a clear breakdown of what to expect with the Chase Freedom Flex® card.

- Introductory APR: 0% for 15 months on purchases and balance transfers.

- Ongoing APR: 18.74% – 28.24% variable, depending on your credit score.

- Cash Advance APR: Up to around 29.24% variable.

- Penalty APR: Up to 29.99% if you miss a payment or have one returned.

- Annual Fee: $0.

- Foreign Transaction Fee: 3% of each transaction in U.S. dollars.

- Balance Transfer Fee: Around 3% – 5% of the transfer amount, depending on current terms.

- Late Payment Fee: Up to $40 if your payment is delayed.

- Returned Payment Fee: Up to $40 if your payment is returned unpaid.

- Minimum Interest Charge: None.

Credit & Eligibility Requirements

Before applying, it’s essential to understand the main requirements that determine your eligibility.

Meeting these conditions increases your chances of quick approval and smooth processing.

- You must be at least 18 years old.

- A U.S. residential address (not a P.O. box) and a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) are required.

- A good to excellent credit score — usually 670 or higher — improves approval odds.

- You need a steady income source that supports your ability to meet monthly payments.

- Applicants should not exceed the “5/24 rule” — if you’ve opened five or more credit cards within the last 24 months, approval may be denied.

- Existing customers with a positive relationship with Chase (such as maintaining accounts in good standing) often have higher chances of approval.

Prepare to Apply Online

Getting ready before you apply online helps you complete the process faster and avoid delays. Here’s what you need to prepare for a smooth and secure application.

- Gather personal information: Have your full legal name, date of birth, U.S. residential address, and contact details ready.

- Provide identification details: You’ll need your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Include financial information: Be prepared to share your annual income, employment status, and monthly housing costs (rent or mortgage).

- Use a secure connection: Apply only through the official Chase website on a private network to protect your data.

- Check your credit report: Make sure there are no errors that could lower your score before applying.

- Review the terms and rates: Read the latest pricing and rewards information so you understand the costs and benefits.

- Have documents on hand: Keep a copy of your photo ID (like a driver’s license or passport) in case verification is required.

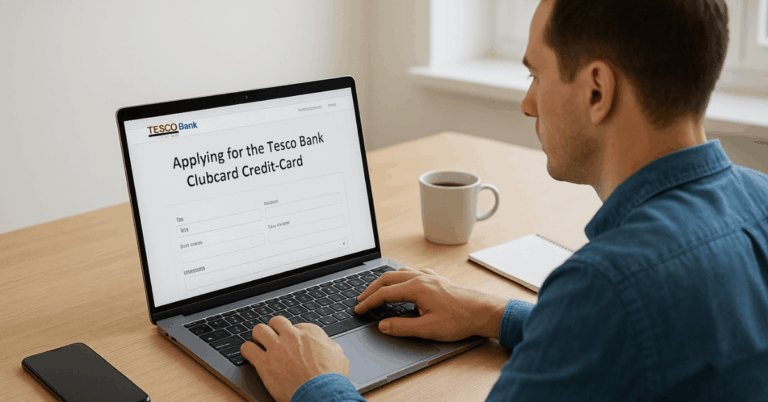

Step-by-step: How to Apply Online

Applying online is quick when you know what each step means. Here’s a breakdown of the main steps with short explanations for each.

- Visit Website: Go to the official Chase credit card page to start the secure application process.

- Click Apply Now: Select the button to open the online form for new applicants.

- Enter Personal Info: Fill in your legal name, date of birth, address, and contact details.

- Add Identification: Provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Include Financial Details: Report your annual income, employment status, and monthly housing payments.

- Review Terms: Read all rates, fees, and rewards terms before submitting.

- Submit Application: Agree to the credit check and send your application for review.

- Wait for Decision: You may get an instant result, or Chase may contact you for further verification.

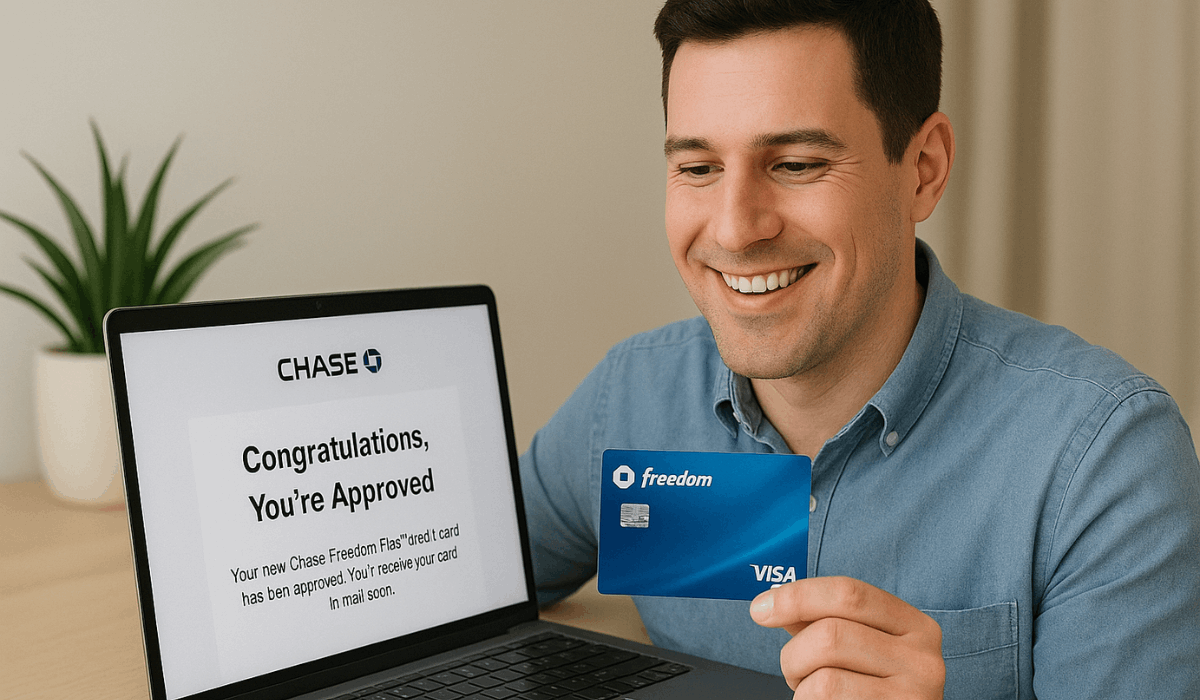

What Happens After Approval / What If You’re Declined

Here’s what happens after you apply — both if you’re approved and if your application is declined. Knowing the next steps helps you act quickly and confidently.

- Approval received: You’ll see a decision (often instantly) and then receive the card by mail within about 7-10 business days.

- Activate your card: Once it arrives, you must activate it (via phone or online) to begin using it.

- Start using rewards: After activation, you can begin earning the card’s cash back bonuses.

- Declined decision: You’ll receive a letter or online message explaining why the application was denied.

- Common denial reasons: Low credit score, insufficient income, high debt, and too many recent applications.

- Consider reconsideration: If you believe you meet the criteria, you can call the issuer’s reconsideration line to request a second review.

- Improve and reapply later: Use the information from your denial to improve your credit profile and consider reapplying after some time.

Contact Information

If you need help with your account or have questions about your application, Chase provides several official contact options.

Below is the verified list of phone numbers you can use depending on your concern.

- Customer Service (Credit Cards): 1-800-432-3117 — For general inquiries, billing questions, or account assistance.

- Lost or Stolen Card: 1-800-432-3117 — Report a lost or stolen card immediately to prevent unauthorized use.

- Make a Payment by Phone: 1-800-436-7958 — Use this number if you prefer to pay your balance over the phone.

- Application Status Inquiry: 1-888-338-2586 — Call to check the progress or decision status of your recent credit card application.

- Mailing Address: Cardmember Services, P.O. Box 15298, Wilmington, DE 19850-5298 — For correspondence or document submission.

To Sum Up

Applying online for the Chase Freedom Flex Credit Card is quick and convenient when you’re well-prepared.

You can gather your information, review the terms, and complete the process in minutes from your computer or phone.

If you’re ready to enjoy flexible rewards and no annual fee, visit Chase’s official website today to submit your application.

Disclaimer

Information such as rates, fees, and eligibility requirements may change at any time based on Chase’s official terms and conditions.

Always review the latest details on the official Chase website before submitting your credit card application.