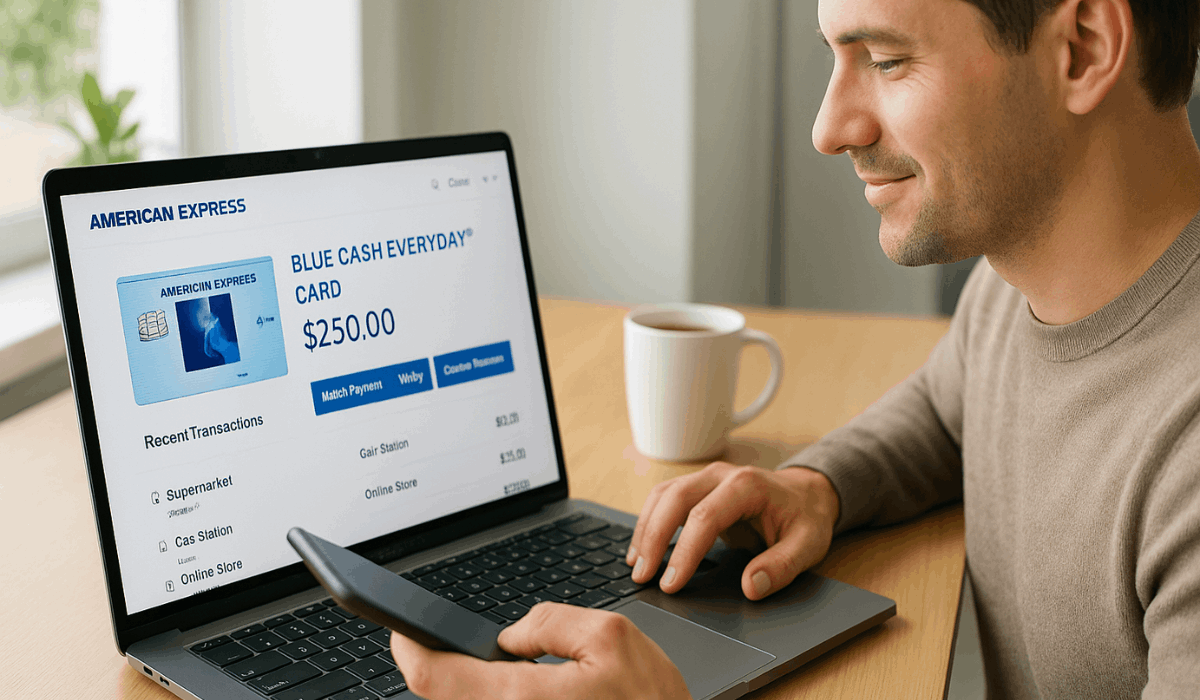

The Blue Cash Everyday® Card from American Express is designed for people who want cash-back rewards without paying an annual fee.

You can earn cash back on everyday purchases like groceries, gas, and online shopping while managing your account efficiently online.

This guide explains how to apply for the card online, what to expect, and key details such as interest rates and fees.

Card Overview

The Blue Cash Everyday® Card offers 3% cash back on groceries, gas, and online shopping with no annual fee.

It comes with a 0% introductory APR for 15 months on purchases and balance transfers, followed by a variable APR of 19.99%–28.99%.

Key Features

This card is designed to reward your everyday spending — especially groceries, gas, and online purchases — while keeping costs low with no annual fee.

- 3% cash back on purchases at U.S. supermarkets, U.S. gas stations, and U.S. online retail (up to $6,000 each category per year; then 1%).

- No annual fee.

- 0% introductory APR on purchases and balance transfers for 15 months (then a variable APR of ~19.99%-28.99%).

- Rewards earned as “Reward Dollars” which you can redeem for a statement credit or use at checkout (e.g., Amazon.com).

- Additional statement-credits for certain subscriptions (e.g., up to $7/month for a bundle at Disney+/Hulu/ESPN+ when enrolled).

- Foreign transaction fee of 2.7%.

Interest Rates & Fees

Here are the current interest rates and fees for the Blue Cash Everyday® Card so you know exactly what you’re signing up for.

Be sure to check the issuer’s website for the most up-to-date numbers before applying.

- Introductory APR: 0% on purchases and balance transfers for 15 months from the date of account opening.

- Ongoing Purchase APR: 19.99%-28.99% Variable after the intro period ends.

- Balance Transfer Fee: 3% of the amount transferred (minimum $5).

- Cash Advance APR: Approximately 29.49%-29.99% Variable.

- Cash Advance Fee: 5% of each cash advance (minimum $10) in many cases.

- Foreign Transaction Fee: 2.7% of each transaction made in a foreign currency after conversion to U.S. dollars.

- Annual Fee: $0 (no annual fee).

Pre-application Checks

Before you apply for the Blue Cash Everyday® Card, it’s smart to check whether you meet the key requirements.

That way, you reduce surprises and improve your chances of approval.

- You must be 18 years or older.

- You need a valid U.S. mailing address (no P.O. boxes often) and a Social Security Number (or ITIN).

- Your credit score should be in the “good to excellent” range (around 670 or higher) to have strong approval odds.

- You need a steady income to cover monthly payments; there’s no set minimum, but your overall finances matter.

- Use the issuer’s pre-qualification tool (soft credit pull) to check your odds with no impact on your credit score.

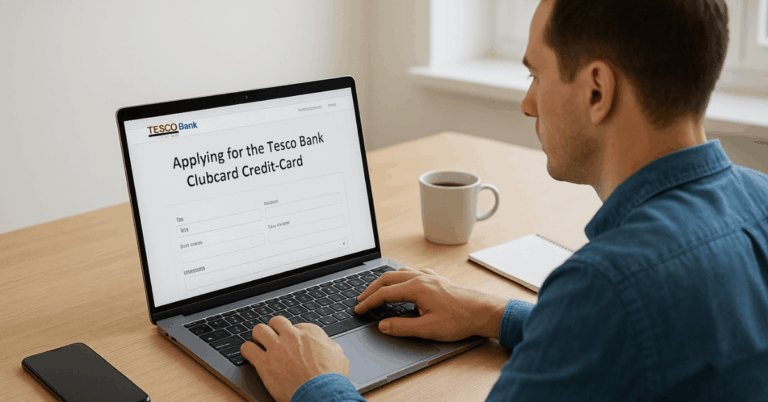

Step-by-step Online Application Process

Here’s how you can apply for the Blue Cash Everyday® Card online from start to finish.

The process is simple and only takes a few minutes if you prepare your details in advance.

- Go to the official American Express website. Search for the Blue Cash Everyday® Card and click “Apply Now.”

- Review the card terms. Check the cash-back structure, introductory APR, and fees to ensure they fit your needs.

- Fill out the online form. Provide your personal information, address, income, and Social Security Number (or ITIN).

- Verify your information. Make sure every field is accurate before submitting to avoid delays or rejection.

- Submit the application. American Express may perform a soft credit pull initially, followed by a hard inquiry if you proceed.

- Wait for a decision. Some applicants receive instant approval, while others may hear back within a few business days.

- If approved, activate your card. Once the physical card arrives, follow the activation instructions and start using your account online.

What to Expect After Applying

Once you’ve submitted your application, here’s what you can expect next — this helps you know how long things might take and what actions are coming.

- You may receive an instant decision if your information is verified quickly; otherwise, it can take up to 10 business days.

- If approved, you might get a temporary card number right away to start using online or via a mobile wallet.

- The physical card typically arrives by mail in 7–10 days after approval.

- If your application is declined, you’ll receive a notification explaining the decision, and you can review your credit report or wait and apply later.

- After your card arrives, you’ll need to activate it, set up online account access, and you can start making purchases to earn rewards.

Benefits & Drawbacks of the Card

Here are the key benefits and drawbacks of the Blue Cash Everyday® Card so you can decide if it fits your needs.

Benefits:

- No annual fee.

- 3% cash back on U.S. supermarkets, U.S. gas stations, and online retail (up to $6,000 per category per year, then 1%).

- Introductory 0% APR on purchases and balance transfers for 15 months (for some offers).

- Rewards redeemable as statement credits or at Amazon.com checkout.

- Strong for everyday spending like groceries, gas, and online shopping.

Drawbacks:

- Requires good to excellent credit for approval.

- 3% cash-back categories capped at $6,000 per category per year.

- Foreign transaction fee (~2.7%) makes it less ideal for international use.

- Some online purchases or merchant types may not qualify for the bonus 3% rate.

Good customer support ensures you can handle card issues, questions, or emergencies easily. Knowing where and how to reach help lets you act quickly when needed.

Customer Support Channels

Good customer support ensures you can handle card issues, questions, or emergencies easily.

Knowing where and how to reach help lets you act quickly when needed.

- Phone (U.S./Canada): 1-800-528-4800 — 24/7 service.

- Phone (general card inquiries or lost/stolen): Use the number on your card’s back or call 1-800-528-4800.

- Online Help Center & Chat: Log into your Amex account, use the “Chat” icon, or visit online support pages.

- Mailing Address (include for written correspondence): P.O. Box 981535, El Paso, TX 79998-1535.

- If you are outside the U.S., you can call: +1-336-393-1111 (collect) for assistance.

- For the Middle East and North Africa region (example: Jordan): Call the number +962 6 5205000.

Final Takeaway

The Blue Cash Everyday® Card is a solid choice if you want reliable cash back without paying an annual fee.

Its simple rewards and online application make it easy to start earning on everyday purchases.

Apply online today through American Express and take control of your daily spending with extra savings.

Disclaimer

Rates, fees, and rewards for the Blue Cash Everyday® Card may change at any time based on American Express policies.

Always review the latest terms and conditions on the official American Express website before applying.