Gaining control over revolving balances starts with a clear plan and the right tool.

Barclaycard Platinum Balance Transfer gives a long interest-free runway on transferred debt, a transparent fee, and strong digital management.

This guide streamlines the essentials, eligibility, timelines, fees, and an online application path, so repayments focus on principal instead of interest.

Barclaycard Platinum Balance Transfer: Key Features

Headline figures vary by status, but several terms appear consistently across Platinum balance-transfer variants.

Barclaycard’s product pages confirm 0% on balance transfers up to 35 months on certain cards, a 60-day transfer window, and a 3.45% fee on each transfer, while representative examples show 24.9% APR (variable) on a £1,200 limit.

| Feature | Typical terms (status dependent) |

| Balance transfer 0% period | Up to 35 months on select variants; transfers within 60 days required |

| balance transfer fee | 3.45% per transfer on common offers |

| 0% purchase period | Often 3 months on select variants; some cards combine longer purchase promos |

| Transfer window | Complete eligible transfers within 60 days of account opening |

| representative APR | 24.9% APR (variable) example on a £1,200 credit limit |

Eligibility and Pre-Checks

Solid preparation improves acceptance odds and avoids unnecessary marks on a credit file. Start by validating basic criteria, then use a soft-search tool to gauge likely outcomes without impacting score.

Basic Criteria

Applicants should be at least 18, resident in the UK, and hold a suitable bank account. Stronger outcomes typically align with stable income and a clean recent credit history.

Barclaycard highlights an online checker that estimates acceptance odds and helps avoid speculative applications.

Soft Credit Check

Barclaycard’s eligibility checker performs a soft credit check, which doesn’t affect credit score or appear to other lenders. This step indicates likelihood of approval prior to any hard search.

Transfer Sources and Limits

Transfers must come from non-Barclaycard credit cards. Barclaycard also notes a 60-day window after account opening to qualify for the promotional 0% rate on balance transfers, so early action matters.

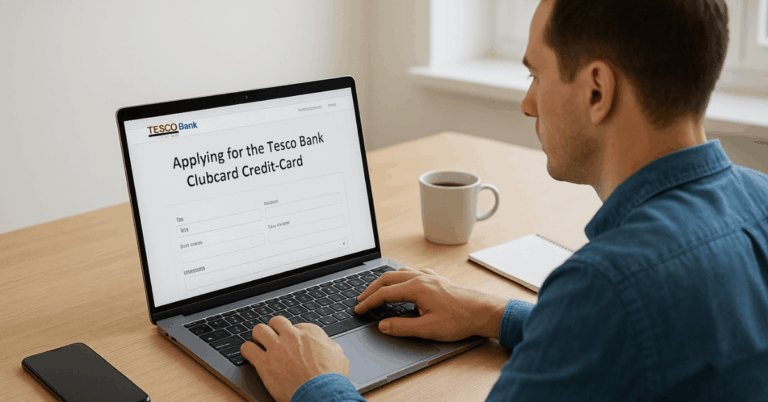

How to Apply Online

A short, accurate application works best when documents and transfer details are ready. The steps below reflect the fastest clean path from initial check to card activation.

- Begin with the checker, then complete the full form only if the result looks reasonable for your profile. Include transfer requests during setup to benefit from the 60-day clock.

- Run the Barclaycard eligibility checker to gauge acceptance odds with a soft search.

- Proceed to the full online form if pre-approved or shown a strong likelihood of acceptance.

- Enter accurate personal, address, employment, income, and outgoings details.

- Add the creditors to be paid, transfer amounts, and confirm the balance transfer fee implications.

- Review disclosures, consent to checks, and submit; approval decisions typically arrive quickly.

- On approval, set a Direct Debit for at least the minimum to protect promotional terms and payment history.

How the Interest-Free Periods Work

Understanding timelines prevents accidental interest and preserves the promotional advantage. Two clocks commonly apply: one for transfers and one for new purchases.

0% on Balance Transfers

Eligible balances moved from other providers within 60 days usually qualify for the long 0% period quoted on the card. Transferring early maximises the term because the countdown starts from account opening, not the transfer date.

0% Purchase Period

Some Platinum variants include a 0% purchase period, often three months, useful for short-term cash-flow smoothing. Treat this cautiously during a payoff plan because purchases convert to the standard variable rate after the intro phase.

After the Promo

Once the promotional end date passes, standard interest rates apply to any remaining purchase or transfer balances.

The representative example widely shown is representative APR 24.9% (variable) on a £1,200 limit, though individual outcomes vary by status and market conditions.

Fees, Rates, and Key Conditions

The balance transfer fee is typically 3.45% and is added at the time of transfer; that cost should be factored into the repayment plan.

No-interest windows require timely minimum payments; missing one risks loss of promotional terms and may trigger fees.

Transfer eligibility generally excludes other Barclaycard accounts, and the 60-day rule remains critical for the full promotional period. Official pages outline the 60-day transfer window, fee level, and example APRs for clarity.

Managing Your Account

Consistent habits keep the plan on track and remove avoidable friction. Digital tools make monitoring, reminders, and statements straightforward.

Barclaycard App

Account management runs smoothly through the Barclaycard app and online servicing.

Balance checks, transaction monitoring, statement downloads, and secure payment confirmations are standard features, alongside in-app support. Official messaging emphasises convenient control from anywhere.

Direct Debit Payment and Alerts

Setting a Direct Debit above the minimum prevents missed payments and preserves promotional terms.

Calendar reminders and statement alerts add redundancy so due dates aren’t overlooked. These behaviours align with Barclaycard’s own guidance on maintaining credit health.

Tips to Maximize Your 0% Balance Transfer

Small operational choices often decide the real-world savings on a promotional plan. These practices keep interest at zero and move the principal down steadily.

- Aim to clear the full promotional balance before the end date, using fixed monthly targets and activity checks inside the app.

- Pay more than the minimum to accelerate principal reduction during the 0% window.

- Avoid new spending on the card while a large transfer is being cleared.

- Log in weekly to confirm posted payments and watch the remaining term.

- Set reminders for the transfer deadline and promotional end date.

- Keep a buffer for contingencies so the final statement clears on time.

Consumer Protections Worth Knowing

Large purchases sometimes accompany balance-transfer plans, making statutory protections relevant. Section 75 of the Consumer Credit Act provides powerful recourse for qualifying transactions.

Section 75 protection

Where a credit card funds a purchase priced over £100 and up to £30,000, the issuer shares liability with the merchant for misrepresentation or breach of contract.

Guidance from MoneyHelper, the FCA, and the Financial Ombudsman Service explains eligibility and claims.

Comparisons and Alternatives

Competing issuers may advertise slightly longer transfer periods, lower fees, or different purchase promos. Decision quality improves by weighing the months of 0% against the balance transfer fee, any purchase intro, and post-promo rates.

UK market leaders update terms frequently; always verify current durations and fees on official pages before applying and prefer providers with clear eligibility checkers that run a soft credit check.

Customer Support and Contact

Questions on an application, eligibility result, or transfer status can be handled online or by phone. Barclaycard lists general lines for UK customers and an overseas number for calls from abroad.

For general help, call 0800 151 0900 in the UK or +44 1604 230 230 from overseas. Additional contact options appear on the official support pages, including application-status checks.

Is Barclaycard Platinum Right for You?

Consider this card if a long 0% transfer term plus a predictable fee fits a structured payoff plan. Strong candidates run the checker first, apply once, complete transfers within 60 days, and automate payments to protect promotions.

Shoppers wanting fee-free travel spending or frequent cash withdrawals should evaluate other options, since foreign and cash costs reduce value quickly during a payoff phase.

A disciplined plan, consistent monitoring in the Barclaycard app, and timely payments turn the promotional term into measurable interest savings.