If you’re looking to rebuild your credit score in the UK, the Aqua Advance Credit Card is designed to help you do just that.

It targets individuals with limited or weak credit histories, offering a manageable credit limit and the opportunity to demonstrate responsible borrowing.

Below, you’ll find everything you need to know about how to apply online, the eligibility criteria, rates, and contact information.

What Is the Aqua Advance Credit Card?

The Aqua Advance Credit Card belongs to a family of credit-builder cards.

Its designed to help consumers improve their credit ratings through consistent, on-time repayments.

While details can vary slightly depending on the offer, it generally works as an entry-level credit card with a moderate limit and no annual fee.

The card is intended for UK residents who want to establish or repair their credit profile while having access to standard Visa features.

Accessibility

Applicants who have been declined elsewhere often find Aqua’s approval criteria more flexible.

Once approved, users can manage their account through the Aqua app.

It allows them to check balances, view transactions, make payments, and track their progress toward better credit health.

Eligibility and Requirements

To qualify, you must be at least 18 years old, a UK resident, and hold a UK bank or building society account.

Applicants currently in bankruptcy or with a recent County Court Judgement are not eligible.

You also cannot apply if you already have another Aqua card or have held one in the past 12 months.

Your financial situation, credit history, and income will still undergo a detailed assessment to determine your suitability and the terms you will be offered.

Interest Rates, Fees, and Charges

The Aqua Advance Credit Card typically comes with a representative APR of 34.9% variable for purchases.

If you use your card for cash withdrawals, a 5% fee (minimum £4) will apply, and interest will begin accruing immediately.

Late payments or exceeding your credit limit each incur a £12 fee.

There is no annual fee for maintaining the account, and Aqua generally provides starting credit limits between £250 and £1,200, depending on your profile.

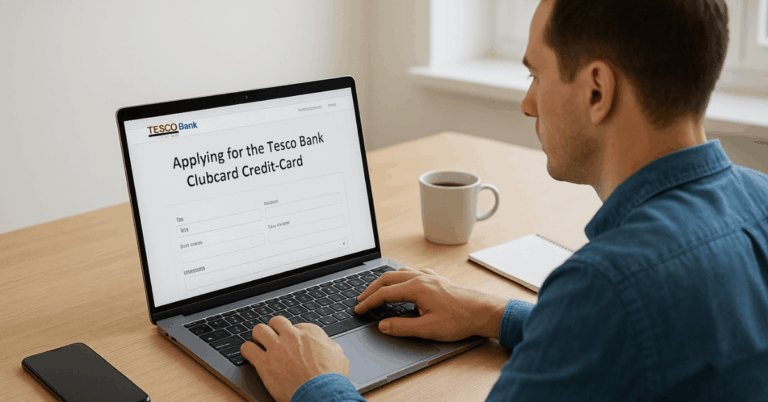

How to Apply Online

Applying for the Aqua Advance Credit Card online is a simple process designed to give you a quick decision without affecting your credit score initially.

Visit the official Aqua website

Navigate to the credit cards section and select the Aqua Advance option.

Use the eligibility checker to see your chances of approval. This soft check won’t appear on your credit file.

Fill out the online application form

Provide personal details such as your full name, date of birth, address history, employment information, and income.

Aqua also requires you to have a valid UK bank account to set up payments.

Submit your application

After submitting, Aqua will run a credit and affordability check.

Many applicants receive an instant decision, while others may need to provide additional documentation.

Review and accept the offer

If approved, you’ll be given your credit limit and terms. Once you accept, your card will be dispatched, usually arriving within 7–10 business days.

Activate and manage your account

You can activate your card online or over the phone.

Afterwards, you can manage it through the Aqua mobile app or online portal to check statements, make payments, and track your credit progress.

Managing Your Card Responsibly

Because this is a credit-builder card, the key to success lies in consistent and disciplined use.

Paying your full balance each month avoids high-interest charges and shows lenders that you can handle credit wisely.

Setting up a Direct Debit for at least the minimum payment helps you avoid missed deadlines, which could otherwise harm your score.

Keeping your utilisation rate below 30% of the available credit is a strong signal of financial stability.

The Aqua App

The mobile app provides helpful tools such as spending notifications, due-date reminders, and access to your credit score through Aqua Coach.

These resources are valuable for monitoring your financial progress and staying on top of repayments.

You can download it for free and keep it on your phone for better management.

Things to Consider Before You Apply

While the Aqua Advance card is useful for building credit, it’s not designed for long-term borrowing due to its relatively high interest rate.

It’s best suited for people who can pay off their balance each month, use the card for regular small purchases, and avoid carrying debt.

If you already have a moderate or strong credit history, you might qualify for cards with lower APRs or reward schemes.

However, for those focused on repairing or establishing credit, Aqua Advance offers a practical starting point with transparent fees and online management.

Contact Information

For inquiries, lost cards, or account management, you can reach Aqua’s customer service through the following channels:

- Issuer: NewDay Ltd

- Registered Address: 7 Handyside Street, London N1C 4DA

- Customer Service Phone: 0333 220 2691

- Postal Address: Aqua Customer Services, PO Box 173, Sheffield S98 1JW

- Operating Hours: Monday to Friday, 9 a.m. to 6 p.m.; Saturday, 9 a.m. to 4 p.m.; closed on Sundays

These contact details apply to all Aqua cards, including Aqua Advance, Classic, and Reward variants. Calls are charged at standard UK rates.

Conclusion

The Aqua Advance Credit Card is a practical option for UK residents seeking to rebuild or strengthen their credit history.

Its online application is fast, transparent, and beginner-friendly, with a pre-check tool that protects your credit score.

Although the interest rate is higher than average, it’s manageable if you consistently pay on time and avoid carrying balances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Terms, conditions, and interest rates may change over time. The representative APR of 34.9% variable applies as of the current publication date and may differ for individual applicants. Always verify details directly with Aqua before applying, and consult a qualified financial adviser if you need personalised guidance. Approval is subject to credit status and affordability checks.