Apple Credit Card targets iPhone users who want simple rewards, strong privacy, and integrated account tools. The card runs on Mastercard, charges no fees, and returns Daily Cash on every purchase.

Availability currently extends to qualifying U.S. applicants, with Goldman Sachs Bank USA, Salt Lake City Branch listed as the issuer. Variable APRs for new accounts range from 18.24% to 28.49% as of July 1, 2025.

What the Apple Credit Card Is

Apple’s card lives in the Wallet app and can also be used as a titanium card or virtual card number.

Daily Cash posts automatically, and eligible merchants deliver 3% when paying with Apple Pay, while other Apple Pay purchases earn 2%. Physical card or virtual number transactions earn 1% and appear alongside real-time spending summaries.

Apple emphasizes a privacy-first design, including device authentication and dynamic security codes for Apple Pay purchases. Apple also states the issuer relationship and data use clearly in its privacy disclosures and support guide.

Eligibility and Apple Card Requirements

Applicants must be at least 18, be a U.S. citizen or lawful resident with a physical U.S. address or military address, and use an iPhone or iPad with the latest software.

An Apple Account with two-factor authentication is required, and any credit freeze must be lifted before applying. Eligibility remains U.S.-only, and Apple currently identifies Goldman Sachs Bank USA as the issuer.

A soft inquiry displays terms during application; accepting the offer triggers a hard inquiry that can affect your score. The device region must be set to the United States to begin the application flow.

How to Apply for an Apple Credit Card

The smooth setup starts in Wallet on a compatible device and typically takes minutes. Expect to review the Customer Agreement, proposed APR, and starting limit before deciding.

Applicants who accept the offer get instant provisioning to Wallet and can request a titanium card afterward. Those who apply online without adding Apple Card to an owned, eligible device will face usage limits until the card is added to Wallet.

On iPhone

Open Wallet, tap Add (+), choose Apple Card, and continue. Complete the application, review Terms, then review the offered limit and APR. Accept to add Apple Card to Wallet; request a titanium card if desired.

On iPad

Open Settings → Wallet & Apple Pay → Add Card → Apple Card, then follow prompts. Add the card to Wallet to access all features and default it for Apple Pay if preferred.

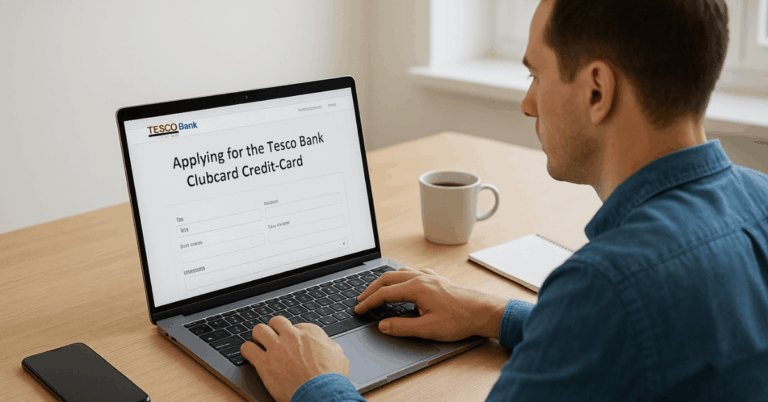

Online

Applications can start on the web; full functionality requires adding the card to an eligible iPhone or iPad you own. Apple notes online-only use is otherwise restricted to eligible purchases through Apple channels.

Rates, Fees, and Financing

Variable APRs for new accounts currently range from 18.24% to 28.49% based on creditworthiness. Existing customers can see their APR inside Wallet or at card.apple.com.

Apple highlights “no fees,” including no annual fee, late fee, foreign transaction fee, or over-the-limit fee.

Interest still accrues on carried balances, and ACMI must be selected at checkout to receive 0% on eligible Apple devices. Taxes and shipping on ACMI purchases accrue interest at your variable APR.

Rewards and How to Maximize Daily Cash

Daily Cash rewards are automatically credited and can be used with Apple Pay, sent to contacts, or moved to a bank. The highest earn rates apply to Apple and list 3% partners whenever Apple Pay is used with Apple Card.

Many purchases pay 2% through Apple Pay and 1% when using the titanium card or virtual number.

Savings integrations allow Daily Cash to flow into an Apple Card Savings account provided by Goldman Sachs Bank USA, with no minimum balance and management in Wallet. Moving funds out to an external bank typically takes one to three business days, according to Apple’s savings guidance.

Security and Privacy

Apple Pay transactions require Face ID or Touch ID and use a unique, dynamic security code rather than sharing the actual card number.

The physical titanium card prints no number, CVV, or expiration date, reducing exposure if lost. Apple’s privacy notice details identity checks and how the issuer and Apple Payments Services LLC support the program.

Sharing With Apple Card Family

Account owners can invite participants or a co-owner within the same Family Sharing group.

Co-owners are each fully liable for the entire balance, see all activity, and are reported as owners to credit bureaus; co-ownership can affect both parties’ credit if payments are missed. Participants 18 and over may build credit when configured.

Managing the Account

Wallet provides real-time transactions, spending categories, payments, autopay, and statement downloads. Account management is also available on the web at card.apple.com, and Apple explains how to add Apple Card to other devices, including Apple Watch.

Apple Support lists phone contact for U.S. territories and confirms the issuer relationship. For written correspondence and payments, Apple provides a Philadelphia lockbox address in its support materials.

Pro Tips to Strengthen Approval and Use

Set your device region to the United States before applying and enable two-factor authentication. Keep utilization low and remove any active credit freeze temporarily so underwriting can proceed.

Add the card to Wallet immediately after approval to unlock all features and merchant acceptance.

Use Apple Pay where available to capture 2% and 3% tiers, then default to a flat-rate 2% card when Apple Pay isn’t accepted. Review co-ownership risks carefully before enabling Apple Card Family and confirm reporting preferences.

Competitor Snapshot

Flat-rate 2% cards remain a useful companion when Apple Pay isn’t available, helping maintain at least 2% back on non-Apple Pay transactions.

Examples often cited by reviewers include Citi Double Cash and Wells Fargo Active Cash for simple cash-back coverage, while category cards like Chase Freedom Unlimited or Capital One SavorOne can outperform in specific spend buckets.

Match secondary cards to routine expenses rather than chasing rotating promotions, then keep Apple Card for Apple Pay purchases and 3% partners.

Issuer and Program Changes

Industry coverage has noted potential shifts in Apple’s consumer-finance partnerships.

Apple Support pages, as of August 4, 2025, continue to list Goldman Sachs Bank USA, Salt Lake City Branch as the issuer; check the current Apple Support page before applying for the latest status.

Conclusion

Straightforward fees, instant provisioning, and Wallet-native controls makethe Apple Credit Card compelling for Apple Pay users.

Strongest value appears when purchases route through Apple Pay and eligible 3% partners, with ACMI delivering 0% financing on selected Apple hardware at checkout.

Review Apple Card requirements, scan your credit reports, manage utilization, and apply when your profile supports the best possible Apple Card APR.