Sorting out the American Express Gold Card online takes a clear plan and verified details.

Strong food-forward rewards, flexible payment features, and easy-to-use statement credits make it a high-value everyday card when the terms fit your situation.

Expect variable welcome offers, a published Amex Gold annual fee of $325, and no foreign transaction fees on purchases made outside the U.S., all backed by official sources noted throughout.

What the American Express Gold Card offers

The card earns 4X Membership Rewards® points at restaurants worldwide (including U.S. takeout and delivery) up to $50,000 per calendar year, 4X points at U.S. supermarkets up to $25,000 per calendar year, 3X on flights booked directly with airlines or on AmexTravel.com, and 2X on prepaid hotels and other eligible travel booked via AmexTravel.com.

Statement Credit

Statement credits are practical and recurring after enrollment: $120 Uber Cash split as $10 monthly, $120 Dining Credit as $10 monthly at select partners, $100 Resy Credit split semi-annually, and an $84 Dunkin’ Credit as $7 monthly.

The Hotel Collection

Access to The Hotel Collection adds a $100 experience credit on eligible two-night minimum stays booked through AmexTravel.com, with room-upgrade potential at eligible properties.

Card Design

Card design is a preference call rather than a feature difference; choose Gold or Rose Gold during application, with the same benefits either way.

Welcome Offer

Welcome offers change. The current public flow directs applicants to apply and then view the targeted offer; ranges on the landing page can show high headline bonuses contingent on spend within a set period, and eligibility varies.

No foreign transaction fees help global purchases price cleanly in non-U.S. currencies when the merchant’s processor runs abroad.

Current Rates, Fees, and Key Limits

Plan around the figures disclosed in the online Rates & Fees and Pricing & Terms prior to submission. The Amex Gold annual fee is $325.

Up to five Additional Cards carry no annual fee; a $35 fee applies to each Additional Card beyond five. The Pay Over Time feature carries a variable APR; on the card’s U.S. landing page, American Express currently shows a 19.99%–28.99% variable APR range for eligible charges. Terms apply and can change without notice.

Plan It®

Plan It® allows fixed-fee installment plans on eligible purchases; American Express documentation states a monthly plan fee up to 1.33% based on APR and plan duration.

Interest calculation typically follows the Average Daily Balance method, as described in cardmember agreements. Always review the live agreement in your application flow.

No Preset Spending Limit

The card features No Preset Spending Limit (NPSL), meaning purchasing power adapts over time to your history and profile.

The assigned Pay Over Time Limit is separate; amounts above that limit generally fall due in full. The Check Spending Power tool can test larger transactions before purchase.

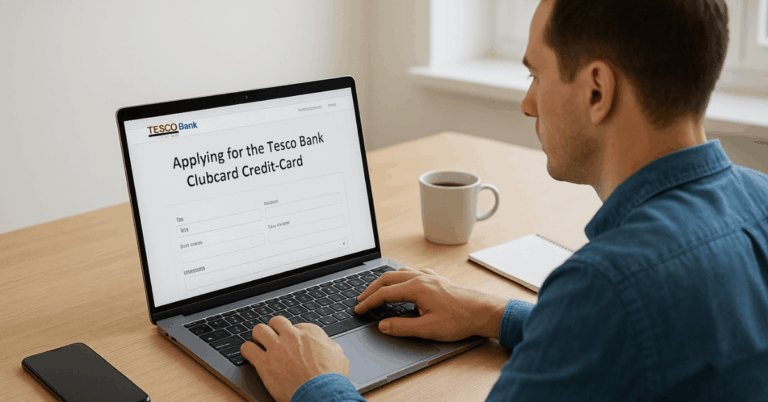

How to Apply for the American Express Gold Card Online

Plan to review real-time terms and use official eligibility tools before submitting. Many applicants receive a decision quickly; some may be asked for additional information.

- Start at the official Gold Card page. Open the American Express credit cards hub, navigate to Gold, and review the latest earnings, credits, and Pricing & Terms. Use Apply with Confidence when shown to check approval with no credit score impact.

- Consider pre-qualification. Use the Amex pre-qualified offers tool to gauge potential eligibility without a hard inquiry.

- Complete the application accurately. Enter legal name, date of birth, U.S. residential address, Social Security Number (or ITIN), contact details, and total annual income. Expect consent for a credit report during full submission.

- Review final terms. Confirm the variable APR range for Amex Gold Pay Over Time, annual fee, and fees displayed at submission. Submit and watch for instant approval or a follow-up request.

- Begin using your card digitally. If eligible, Amex may provide an Instant Card Number for use in digital wallets pending physical delivery.

Spending power and Pay Over Time, explained

NPSL does not mean unlimited. Purchasing power adjusts to payment patterns, credit history, and other factors.

The Pay Over Time Limit caps the amount that can revolve with interest; charges exceeding that threshold typically post to your Pay-in-Full balance and must be paid by the due date. The Check Spending Power tool helps confirm approval likelihood for a large charge before swiping or checking out.

Plan It can smooth larger purchases at a fixed monthly fee up to 1.33% per active plan. Treat this like a financing cost alongside any interest on revolving balances; the disclosure appears when creating a plan.

Eligibility and Documents You’ll Need

Solid preparation shortens the application and reduces verification loops. Expect the following items:

- Identity and contact: legal name, date of birth, SSN/ITIN, U.S. residential address, email, and phone.

- Income details: total annual income and source; additional employment information may be requested.

- Optional checks: use Amex’s pre-qualification tool before a full application to reduce surprises.

Statement Credits and Perks in Practice

Monthly credits are easiest when enrollment is completed immediately after approval.

Add the card to Uber to activate Amex Gold Uber Cash for $10 monthly in the U.S. stack; enroll for the Amex Gold Dining Credit ($10 monthly at participating partners), the $100 semi-annual Resy split, and the $7 monthly Dunkin’ credit.

The Hotel Collection benefit provides a $100 experience credit on qualifying two-night minimum bookings through AmexTravel.com, with credit categories that vary by property and a possible room upgrade upon check-in when available.

Amex Gold vs. Other Amex Cards

A quick, side-by-side view helps frame alternatives. Expect dynamic perks across products, all subject to change; confirm live terms before any decision.

| Card | Core earning | Notable credits/perks | Best for |

| Amex Gold | 4X restaurants worldwide; 4X U.S. supermarkets (caps apply); 3X flights; 2X prepaid hotels; 1X other | $120 Uber Cash; $120 Dining; $100 Resy; $84 Dunkin’; The Hotel Collection access (two-night min.) | Food-centric households and travelers who’ll actually use monthly credits. |

| Amex Platinum | 5X flights booked directly or via AmexTravel.com; 5X prepaid hotels via AmexTravel.com; 1X other | Global Lounge Collection; annual hotel credit; various statement credits; elite hotel status (enrollment req.) | Frequent flyers seeking premium travel benefits. |

| Amex Green | 3X travel, 3X transit, 3X dining; 1X other | Elevated earn on travel/transit; no FTF | Travelers wanting solid earn without premium-tier fees. |

How to Activate and Set Up Benefits

Post-approval, create or sign in to your online account, confirm delivery status, and enroll in Dining, Resy, Dunkin’, and Amex Gold Uber Cash.

Adding the card to Uber activates the monthly credit. Autopay and alerts reduce missed payments, and the Spending Power tool helps tee up bigger purchases responsibly.

Instant Card Number, when offered, enables immediate digital use while the metal card ships.

Is the American Express Gold Card Worth It?

Households that concentrate spend in restaurants and U.S. supermarkets typically harvest outsized rewards versus many flat-rate options.

When the monthly Dining, Uber, Resy, and Dunkin’ credits fit your routine, the effective net cost shrinks quickly.

Conversely, limited food spending or inconsistent credit usage reduces value, and a simple cash-back card may suit better. American Express provides transparent tables for fees, APRs, and additional card policies so you can run the math before committing.

Contact and Headquarters

For U.S. personal card servicing, the primary customer-service line is 1-800-528-4800, available 24/7.

To apply by phone, call 1-888-297-1244 (8 a.m.–11 p.m. ET, seven days). Application status can be checked online or via 1-877-239-3491.

The company’s headquarters address is American Express Company, 200 Vesey Street, New York, NY 10285; the main switchboard is 212-640-2000.

Bottom line

Solid rewards on food spending, Amex Gold benefits that are easy to redeem, and transparent pricing make the American Express Gold Card a compelling everyday earner.

Apply online through the official page, confirm your specific Amex Gold welcome offer and APR disclosures, and enroll the monthly credits on day one to capture full value.

Terms apply to all features; always rely on the live Rates & Fees and cardmember agreement shown during your application.